Table Of Contents:

- Introduction to Emerging Market Trading:

- Core Characteristics of Emerging Market Economies:

- Major Trends Driving Emerging Market Trading in 2025:

- Global Supply Chain Shifts Are Redefining Trade Winners:

- De-Dollarization Is Gradually Changing Currency Dynamics:

- ESG and the Green Transition Are No Longer Just Developed Market Trends:

- Mobile Trading and Fintech Booms Are Reshaping Frontier Markets:

- Putting It All Together – Trade the Trends, But Always Check the Terrain:

- Geopolitical and Macroeconomic Forces:

- Political Risk and Unstable Governments – A Constant Underlying Current:

- Inflation and Interest Rate Dynamics – One Size Doesn’t Fit All:

- Sanctions, Trade Wars, and Shifting Alliances – Global Chess with Local Consequences:

- Global Monetary Policy – When the Big Dogs Bark, Everyone Listens:

- Wrapping It Up – Macro Mastery for Smarter Trading:

- Proven Trading Strategies for Emerging Markets:

- Momentum Trading – Tapping into Short-Term Price Surges:

- Value Investing – Finding Undervalued Winners with Long-Term Upside:

- Currency Strategies – Managing FX Exposure and Earning Through Carry:

- Passive Investing – Simple Exposure with Emerging Market ETFs and Index Funds:

- Bonus Strategy – Blending Approaches for a Balanced Portfolio:

- Final Thoughts – It’s Not About Being Right, It’s About Being Ready:

- High-Potential Sectors to Watch in Emerging Economies:

- Natural Resources and Commodities – The Lifeblood of Many Emerging Economies:

- Fintech, E-commerce, and Telecom: The Digital Boomtowns:

- Infrastructure and Renewable Energy – Building for the Future:

- Financial Services – Reform and Innovation Driving Access:

- Healthcare and Biotech – A Quiet Yet Powerful Growth Story:

- Final Word – Opportunity Awaits the Prepared:

- Managing Risk When Trading Emerging Markets:

- Tools and Technologies for Smarter Emerging Market Trading:

- AI and Machine Learning – Turning Big Data into Actionable Moves:

- Mobile and Cloud-Based Trading Platforms – Trade Anywhere, Anytime:

- Localized Data Feeds and Regional News Aggregators – Your Window into the Market Mood:

- Real-Time Analytics – The Engine Behind Smarter Risk and Opportunity Management:

- Bonus – Social Trading and Community Insights:

- Summary Table – Essential Tools for EM Traders in 2025:

- Final Thought:

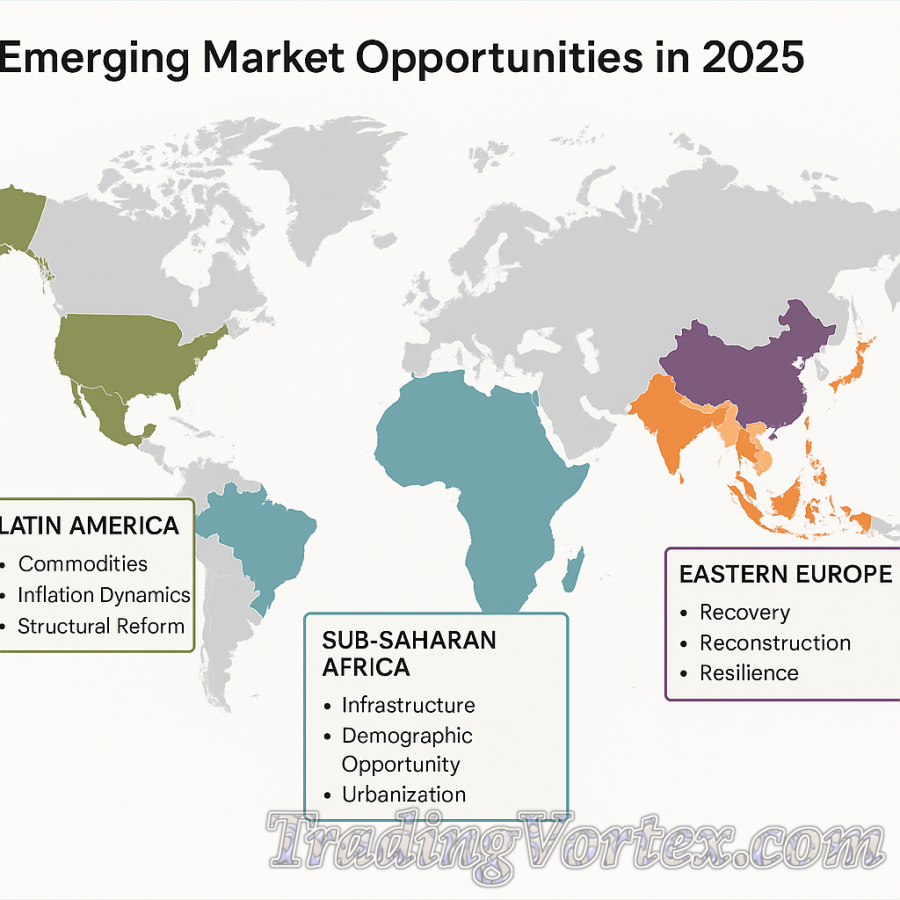

- Regional Spotlights: Where to Focus in 2025?

- Latin America – Commodities, Inflation, and Structural Reform:

- Southeast Asia – Manufacturing, Digital Expansion, and a Rising Middle Class:

- Sub-Saharan Africa – Youth, Urbanization, and Infrastructure Momentum:

- Eastern Europe – Recovery, Reconstruction, and Resilience:

- Summary Table – Regional Outlook for 2025:

- Final Thoughts:

- Institutional and Expert Perspectives:

- Final Thoughts and Key Takeaways:

- Frequently Asked Questions (FAQs):

- Q1. What exactly are emerging markets, and why do traders care so much?

- Q2. Which regions should I keep an eye on in 2025?

- Q3. What trading strategies tend to work best in these markets?

- Q4. How do global events affect emerging market trading?

- Q5. What risks should I be most aware of?

- Q6. What platforms or tools can help me trade smarter?

- Q7. How do I keep up with trends and updates without getting overwhelmed?

Introduction to Emerging Market Trading:

What Are Emerging Markets and Why Do They Matter in 2025?

Now, why should you care in 2025? Because these markets are no longer just the “risky but interesting” part of your portfolio: they’re shaping global trends. The International Monetary Fund projects that emerging and developing economies will account for over 60% of global growth this year. That’s huge. And with supply chains diversifying post-COVID, global capital is looking beyond the usual suspects like the U.S. or Europe. As BlackRock puts it, these regions are “critical to the next leg of global expansion.”

If you're not paying attention to these markets, you’re leaving opportunity on the table. Full stop.

The Growing Appeal of Emerging Economies for Global Traders:

There’s a reason why more institutional and retail traders are jumping into emerging markets. It’s not just about higher potential returns (though, yes, the upside can be wild). It’s also about diversification, access to underpriced assets, and tapping into long-term secular trends — like the growth of digital economies in Africa or the boom in renewable energy investments across Southeast Asia.

And here’s a fun fact: in many of these economies, traditional financial infrastructure is being leapfrogged by mobile money and decentralized solutions. In Kenya, for example, mobile banking adoption is higher than in most Western nations. That creates all kinds of exciting volatility; and if you're a trader, volatility is where the action is.

Also, the barriers to entry are getting lower. With global platforms offering easier access to foreign exchanges and ETFs tailored to specific regions or sectors, even retail traders can get a slice of the action without needing a degree in international finance.

Key Opportunities and Risks in Today’s Emerging Market Landscape:

Trading emerging markets is a bit like surfing: you get incredible momentum, but you need to know how to ride the waves without wiping out. The opportunities are compelling: rapidly growing consumer markets, infrastructure booms, government reforms, tech innovation, and favorable demographics.

But — and it’s a big but — these markets also come with risks you can’t ignore. We’re talking political instability, currency devaluation, capital flight, regulatory unpredictability, and liquidity issues. Just ask anyone who’s tried to exit a position in a less-liquid local exchange during a crisis. It's not for the faint of heart.

In 2025, two key macro factors are especially important: inflation control and geopolitical risk. The IMF’s latest World Economic Outlook points out that while inflation is cooling in developed economies, many emerging markets are still walking a tightrope between stimulating growth and keeping prices under control. Add in shifting alliances and regional tensions (like in Eastern Europe or the Red Sea area), and you’ve got a cocktail that demands caution and strategy.

The trick is to know which waves to ride; and when to get out of the water.

Final Thoughts – The Stage Is Set:

Emerging markets in 2025 are vibrant, dynamic, and full of possibility. Yes, there’s risk, but that’s part of the thrill. With the right tools, research, and mindset, these regions can offer smart traders some of the most rewarding setups anywhere in the world.

Core Characteristics of Emerging Market Economies:

High Growth Potential with High Volatility:

Trading in emerging markets is a bit like stepping into a fast-moving river. The current is strong, the direction isn't always predictable, but if you know how to navigate it, the journey can be incredibly rewarding.

Emerging economies are often in the early or middle stages of industrialization, meaning there’s a lot of room to grow. Infrastructure is being built. Urbanization is accelerating. Technology is spreading rapidly, often bypassing traditional phases of development. In sub-Saharan Africa, for example, mobile payments have leapfrogged the need for brick-and-mortar banking. In India, digital ID systems are enabling a financial inclusion revolution. These shifts create waves of economic activity and investment opportunities.

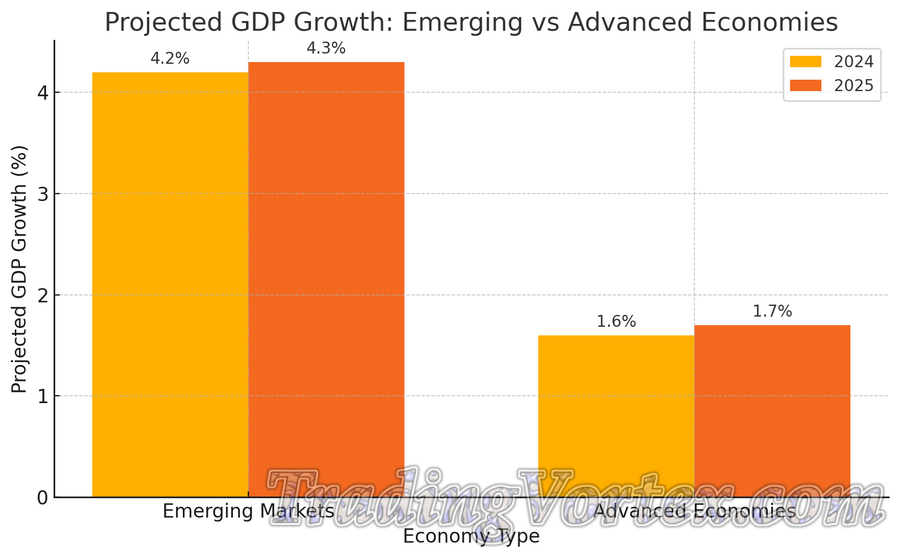

According to the International Monetary Fund’s April 2024 Outlook, emerging and developing economies are expected to grow by an average of 4.2% in 2025, compared to just 1.6% in advanced economies. That growth gap is one of the main reasons global investors continue to pour capital into these regions. They’re not just growing faster. They’re innovating in ways that developed markets often can't, due to legacy systems or saturated industries.

But here’s the kicker: with that high growth comes high volatility. Price swings can be dramatic, even in a single trading session. Market sentiment can shift based on a single speech, an election poll, or a commodity price change. For traders, this is both the opportunity and the challenge. You have to be nimble, informed, and mentally prepared for sharp moves in both directions.

Common Economic and Political Risk Factors:

One of the most important things to understand about emerging markets is that they're shaped as much by politics as they are by economics. And unlike in developed economies, those political shifts can happen quickly and with wide-reaching effects on markets.

Let’s break it down:

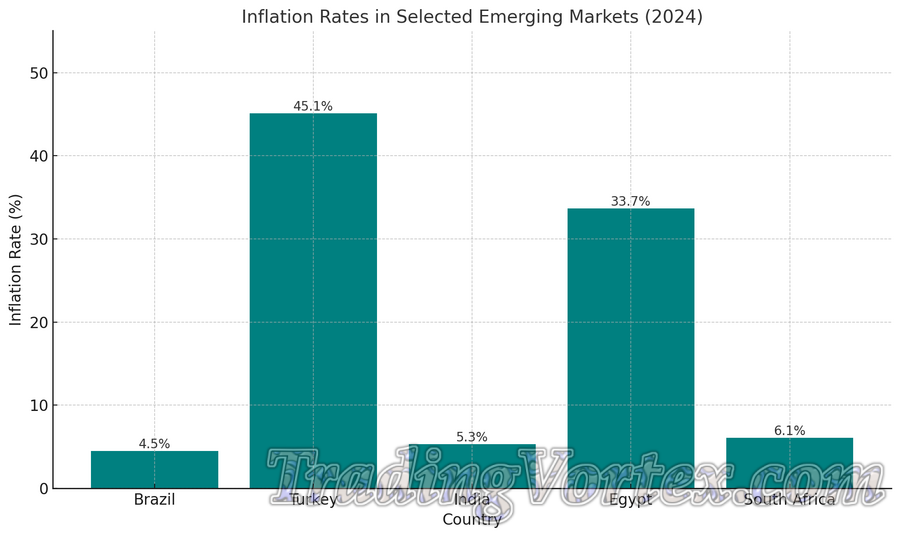

- Inflation Risk: Inflation can be unpredictable in emerging markets. Even countries with strong growth potential like Argentina or Turkey have faced runaway inflation in recent years. Central banks may respond aggressively, hiking interest rates or imposing price controls. For traders, this creates both risks and arbitrage opportunities.

- Political Instability: Elections in emerging markets can bring sweeping changes to policy, regulation, and trade relations. In some cases, governments may lean toward protectionism or nationalization of key industries. A mining company stock may look solid today, but one new regulation or resource tax tomorrow can change everything.

- Regulatory Uncertainty: Unlike in more established economies, regulatory frameworks in emerging markets are often still evolving. Rules on foreign investment, taxation, and financial instruments can shift rapidly. It's not uncommon for new capital gains taxes or currency repatriation restrictions to be announced with little warning. If you're trading or investing in these markets, staying plugged into local news is a must.

- Sovereign Debt and Fiscal Pressure: Many emerging economies rely on borrowing from global institutions or issuing foreign-denominated debt. When global interest rates rise, or when the U.S. dollar strengthens, it puts pressure on these economies to service their debts. This can lead to austerity, social unrest, or even default, as seen in countries like Sri Lanka and Zambia in recent years.

Being aware of these risk factors is not about avoiding emerging markets entirely. It's about understanding the landscape so you can manage your exposure effectively.

How Currency Volatility and Capital Controls Impact Traders:

Currency volatility is often the elephant in the room when it comes to trading emerging markets. You might spot a great setup, time your entry perfectly, and still see your gains erased by a currency that drops 10% in a week.

Why does this happen? Because emerging market currencies are deeply sensitive to factors like inflation, commodity prices, political headlines, and capital flows. For example, if global investors start pulling money out of risky assets due to geopolitical tensions, local currencies can depreciate rapidly, especially in countries with large current account deficits.

Then there’s the issue of capital controls. These are policies governments use to limit the flow of money in and out of the country. They can be used to stabilize currencies, prevent capital flight, or maintain monetary sovereignty. But for traders, they often mean reduced flexibility, lower liquidity, and sometimes even restrictions on repatriating profits.

If you’re considering investing in markets like Nigeria, India, or Malaysia, it’s essential to review whether these controls are in place, and how they’ve historically been used. In some cases, even foreign portfolio investors can face lock-in periods or delays in converting local profits back to U.S. dollars or euros.

To manage these risks, some traders hedge their positions using forex derivatives, while others favor instruments like ADRs (American Depository Receipts) that are denominated in U.S. dollars. Another approach is to focus on ETFs or mutual funds that already factor in currency risk.

Beyond the Basics – Other Traits Worth Noting:

While growth, volatility, and regulation get most of the attention, there are a few lesser-discussed traits that can influence trading strategy:

- Demographics: Many emerging markets have young, growing populations. This drives demand for housing, consumer goods, internet access, and mobile banking. Think of it as the opposite of what’s happening in Japan or parts of Europe.

- Commodities Dependence: A number of emerging economies are heavily reliant on a few key exports—like oil in Nigeria or copper in Chile. This makes their markets highly sensitive to global commodity cycles.

- Shifting Trade Alliances: As the global order evolves, emerging markets are increasingly forming trade blocs and bilateral agreements independent of traditional Western partners. These shifts can unlock new opportunities or reshape existing ones almost overnight.

- Digital Leapfrogging: From blockchain-based land registries to mobile-first banking, emerging markets are often willing to experiment with new technologies at scale. Traders who follow tech adoption trends in these regions can find early signals of long-term growth.

Final Thoughts – Treat Each Market as Its Own Ecosystem:

It’s tempting to lump all emerging markets together, but each one comes with its own ecosystem, drivers, and story. What works in Thailand might not apply in Peru. Even within the same continent, dynamics can differ wildly. For instance, Kenya and South Africa are both key African economies, but their political systems, tech sectors, and market structures have little in common.

The more you treat each country like a unique case study rather than a broad category, the better positioned you'll be to find high-quality trades and avoid costly mistakes.

Trading emerging markets successfully is less about predicting the next boom and more about understanding the underlying mechanics. Learn how these markets breathe. Learn what moves them. And you’ll not only trade better — you’ll start to anticipate opportunities that others miss.

Here is a visual representation comparing the projected GDP growth rates for emerging and advanced economies in 2024 and 2025, based on the IMF's April 2024 World Economic Outlook:

♦ Emerging markets are expected to maintain a strong growth trajectory, reaching 4.3% in 2025.

♦ Advanced economies are projected to grow much more slowly, at around 1.7% in 2025.

This stark contrast underscores why many investors continue to be drawn to emerging markets despite their higher volatility.

Major Trends Driving Emerging Market Trading in 2025:

It’s a fascinating time to be trading in emerging markets. The landscape is shifting fast, and if you're paying attention, there’s a lot more opportunity than meets the eye. In 2025, the traditional story of "high growth but high risk" is getting a much-needed update. Thanks to a mix of global realignments, tech innovation, and financial reforms, emerging markets are no longer just riding global trends: they’re helping drive them.

Let’s dig into the key trends shaping trading strategies right now and what they mean for your next move.

Global Supply Chain Shifts Are Redefining Trade Winners:

One of the biggest drivers of emerging market momentum in 2025 is the evolving shape of global supply chains. The disruptions of the past few years — starting with the pandemic, followed by geopolitical rivalries and logistics bottlenecks — pushed multinational corporations to rethink where and how they source materials and manufacture goods.

Now, instead of relying heavily on a single country like China, businesses are diversifying their production bases. This has created a golden window of opportunity for countries like:

- Vietnam, which continues to benefit from electronics and apparel manufacturing shifts.

- Mexico, whose proximity to the United States and participation in the USMCA trade deal makes it a go-to for nearshoring.

- India, which is attracting billions in semiconductor, defense, and IT investments as it rolls out infrastructure and supply chain incentives.

This shift is more than just corporate logistics. For traders, it signals rising export data, local currency strength, equity market rallies in logistics, energy, and construction, and more opportunities to go long on targeted ETFs and regional indices.

Key takeaway: Follow the supply chains, and you’ll often find early momentum in stock prices, foreign direct investment flows, and export-driven growth that precedes broader market rallies.

De-Dollarization Is Gradually Changing Currency Dynamics:

No, the U.S. dollar isn’t disappearing. But in 2025, it’s clear that more countries are strategically reducing their reliance on it. This trend, often called "de-dollarization," is becoming a major narrative in both policy circles and trading desks.

Here's what's driving it:

- Bilateral trade deals in local currencies are expanding. China and Brazil now settle significant trade volumes in yuan and real. Russia, India, and Southeast Asian countries are also moving in this direction.

- Rising geopolitical tensions are making countries cautious about holding too many dollar-denominated reserves.

- Digital central bank currencies (CBDCs) are making cross-border transactions in local currencies more efficient and viable.

This trend affects how emerging market central banks manage reserves and intervene in forex markets. For traders, it means there’s more movement in cross-currency pairs and more potential to hedge or speculate based on these shifting flows.

Watchlist: Local currency-denominated government bonds, forex pairs like BRL/CNY or INR/RUB, and regional currency ETFs that benefit from reduced USD exposure.

Pro tip: Don’t just trade the currencies — understand the policy signals behind them. Currency strength often reflects broader economic confidence, especially in countries asserting more monetary independence.

ESG and the Green Transition Are No Longer Just Developed Market Trends:

There’s been a quiet revolution in ESG (Environmental, Social, Governance) investing in emerging markets, and it’s gaining serious traction in 2025.

Why now?

- Global climate finance is flowing toward developing countries. From solar parks in India to wind farms in Kenya, green infrastructure is attracting investors hunting for returns with a sustainability profile.

- Sovereign green bonds are becoming more common. Countries like Chile, Indonesia, and Nigeria have successfully issued green bonds to fund clean energy, water, and transport projects.

- Investors are rewarding governance reforms. Countries improving transparency, fighting corruption, and committing to ESG frameworks are seeing more capital inflows and lower borrowing costs.

This creates a whole new layer of opportunity for traders. ESG-aligned assets are not only becoming more liquid but are also less volatile in times of uncertainty, especially as institutional investors increase their mandates for sustainability.

Where to look: ESG-focused ETFs, sovereign green bonds, and companies in emerging markets aligned with renewable energy, clean water, and social impact sectors.

Bonus insight: ESG integration is also improving political stability, which can translate into less tail risk for traders.

Mobile Trading and Fintech Booms Are Reshaping Frontier Markets:

It might come as a surprise, but some of the most exciting fintech action is happening in smaller, less-developed economies. In places where traditional banking never took off, mobile-first solutions are leapfrogging old models and bringing millions into the financial system.

Consider this:

- Nigeria’s mobile banking penetration is over 50%, and platforms like Flutterwave are powering cross-border trade and payments.

- India’s retail investing population exploded during the pandemic and continues to rise, thanks to low-cost apps like Zerodha and Groww.

- In Southeast Asia, fintech startups are offering stock trading, crypto, lending, and insurance products to millions with just a smartphone.

For traders, this is more than just a feel-good tech story. It's a structural shift in how capital markets function. With more retail investors participating, local stock markets are seeing higher liquidity, stronger momentum, and even meme-stock-style volatility in certain regions.

Smart plays: Keep an eye on fintech stocks and ETFs tied to mobile finance in emerging and frontier markets. Also watch for unusual volume spikes or retail-driven moves that create short-term opportunities.

Putting It All Together – Trade the Trends, But Always Check the Terrain:

All of these trends — supply chain realignment, de-dollarization, ESG momentum, and mobile trading innovation — are reshaping how emerging markets interact with global capital. But none of them operate in a vacuum.

As a trader, your best advantage is context. Ask yourself:

- Is this trend backed by solid fiscal and monetary policy?

- Are there any upcoming elections or regulatory shifts that could derail the opportunity?

- How does this trend compare across regions? (e.g., Is India more ESG-ready than Brazil? Is Vietnam less politically risky than Turkey?)

Remember, emerging markets reward those who can balance optimism with caution. The volatility is real, but so is the upside; especially if you’re tuned in to the bigger picture.

Geopolitical and Macroeconomic Forces:

If you’ve ever felt like emerging markets are the Wild West of global finance, you’re not entirely wrong. In 2025, the geopolitical and macroeconomic landscape is just as influential — if not more — than any price chart or technical pattern. It shapes everything from trade flows and investor sentiment to currency valuation and stock market stability.

For traders navigating these markets, understanding the external forces at play isn’t optional, it’s essential.

Let’s break down the big picture and look at how the major political and economic currents are shaping emerging markets right now.

Political Risk and Unstable Governments – A Constant Underlying Current:

Emerging markets are home to immense growth potential, but they often sit on fragile political ground. In 2025, several countries continue to experience political volatility that can shake investor confidence almost overnight.

Political risk doesn’t just mean regime change or revolution. It can include abrupt regulatory changes, nationalization of resources, or currency controls that catch traders off guard. Whether you’re holding long-term positions in ETFs or actively trading currency pairs, staying plugged into local political developments is crucial.

Pro tip: Set alerts for political developments in your target countries and consider diversifying across different regions to balance this kind of risk.

Inflation and Interest Rate Dynamics – One Size Doesn’t Fit All:

The macroeconomic environment in emerging markets is a mixed bag in 2025. Some nations are cooling off after post-pandemic inflation spikes, while others are still battling rising prices.

The lesson here is that emerging markets don’t move in lockstep. Traders should watch each country’s central bank policy carefully, especially because rate decisions can have an immediate impact on currency pairs, equity indexes, and bond yields.

Tip for traders: High interest rates may attract yield-seeking investors, but can also slow economic growth. Always assess the broader context, not just the headline number.

Sanctions, Trade Wars, and Shifting Alliances – Global Chess with Local Consequences:

Geopolitics used to be something reserved for diplomats and analysts. These days, it’s front and center in your trading portfolio.

Just look at how sanctions on Russia have not only reshaped its economy but also altered global commodity flows. As the West pulls back, Russia has leaned more heavily on China, India, and other non-Western partners, which in turn is shifting trade balances and creating new investment dynamics in South Asia and the Middle East.

Then there’s the simmering U.S.-China rivalry, which has expanded beyond tariffs into technology bans, military posturing, and competition for influence in Africa and Latin America. These tensions often spill over into currency volatility, stock market sell-offs, and policy uncertainty across developing nations that depend on these two giants for trade and investment.

What it means for you: Keep an eye not just on the countries you trade in, but also on their biggest partners and political alignments. A tariff on semiconductors or rare earth metals in one region can ripple through markets globally.

Global Monetary Policy – When the Big Dogs Bark, Everyone Listens:

If you’ve ever seen emerging market currencies tank after a U.S. Federal Reserve rate hike, you know how closely tied global monetary policy is to EM performance. In 2025, this relationship is more important than ever.

The European Central Bank (ECB) has recently begun easing its stance to stimulate the Eurozone economy. Meanwhile, the Federal Reserve has signaled it may maintain slightly elevated rates for longer than expected, in an attempt to keep inflation on a tight leash.

For emerging markets, this creates a balancing act. Higher U.S. rates often result in capital outflows from developing countries, as investors chase safer, higher-yielding assets in the U.S. Lower rates from Europe, on the other hand, may give some EMs breathing room to attract capital.

Smart strategy: Monitor not only local central banks but also the "big three" — the Fed, ECB, and the People’s Bank of China. Their policies often dictate the flow of global capital and risk appetite.

Wrapping It Up – Macro Mastery for Smarter Trading:

You don’t need a Ph.D. in political science or macroeconomics to trade emerging markets, but you do need situational awareness. Understanding how geopolitics and global economics shape market conditions can help you avoid landmines, identify high-potential trades, and manage risk with more confidence.

Key takeaways:

- Keep an eye on election cycles and political reforms.

- Track inflation and central bank rate decisions at the local level.

- Pay attention to sanctions, trade disputes, and global alliances.

- Don’t ignore the impact of monetary policy from the U.S., EU, or China.

In short, macro forces may be unpredictable, but that doesn’t mean you can’t use them to your advantage. The better you understand the world, the better you can navigate emerging markets.

Chart illustrating Inflation Rates in Selected Emerging Markets (2024). This visual helps underscore the macroeconomic diversity across regions, which is a key consideration when trading in emerging markets.

Proven Trading Strategies for Emerging Markets:

Navigating emerging markets is like exploring uncharted territory. There’s real treasure out there, but it comes with its share of traps and surprises. If you’ve ever traded in these markets, you know things can shift in the blink of an eye: what looked like a golden setup in the morning can unravel by the afternoon.

That’s why having a clear, well-matched strategy isn’t just a nice-to-have. It’s essential. Whether you're trading on a laptop from your kitchen table or managing a global portfolio, the right approach can help you harness volatility instead of being swept away by it.

Let’s break down the most effective trading strategies currently being used in 2025, with tips for how to make them work in today’s fast-moving world.

Momentum Trading – Tapping into Short-Term Price Surges:

In emerging markets, where news travels fast and volatility can spike on the back of a single headline, momentum trading has become one of the most effective short-term strategies. The goal here is simple: find assets with strong recent price movement and ride the wave until the trend weakens.

Best practices for momentum trading in EMs:

- Stick to liquid assets with high trading volumes.

- Use technical indicators to confirm strength behind the move.

- Avoid holding through high-impact events (e.g., elections or interest rate decisions).

- Set clear stop-losses to avoid large drawdowns.

Pro tip: News-based catalysts matter a lot more in EMs than in developed markets. A strong chart setup without a credible reason behind it can turn into a false breakout fast.

Value Investing – Finding Undervalued Winners with Long-Term Upside:

If momentum trading is about speed, value investing is about patience and conviction. It’s a slower-paced strategy but one that can pay off handsomely over time, especially in emerging markets where inefficiencies and emotional pricing are common.

In countries like Vietnam, South Africa, and Brazil, some sectors are trading well below intrinsic value due to political instability or short-term macro shocks. But when you dig deeper, many of these companies still show solid earnings, strong market positions, and long-term growth potential.

Keys to success in EM value investing:

- Focus on quality businesses with strong cash flows and low debt.

- Look beyond earnings: understand regulatory environments, currency exposure, and domestic demand.

- Monitor reforms, infrastructure investments, and FDI flows, which can unlock value.

Currency Strategies – Managing FX Exposure and Earning Through Carry:

Currencies are often the wild card in emerging markets. A solid stock pick can be completely offset by currency depreciation. On the flip side, FX volatility also creates unique opportunities for savvy traders.

Two popular strategies dominate the EM currency space:

- Hedging Foreign Exchange Risk: If you’re holding equities or bonds in a country with a volatile currency, hedging helps protect your returns. Tools include currency futures, options, or investing in ETFs that naturally offset that exposure.

- Carry Trades: Carry trades are back in style in 2025. They involve borrowing in a low-interest-rate currency (like the Japanese yen) and investing in a high-yield EM currency (like the Mexican peso). The goal is to earn the interest rate difference while betting on currency stability.

Risks to watch for:

- Carry trades can unravel quickly when risk sentiment turns or central banks shift policy.

- Unexpected capital controls or rate hikes can reverse positions overnight.

- Local political developments and inflation surprises often impact currency direction.

Tip for traders: Always consider macroeconomic trends, central bank policies, and geopolitical shifts when entering currency-based strategies. And never put all your eggs in one currency basket.

Passive Investing – Simple Exposure with Emerging Market ETFs and Index Funds:

Not every investor wants to trade daily or analyze charts for hours. Passive investing offers a simpler way to benefit from emerging market growth while spreading out the risks.

In 2025, ETFs and index funds targeting emerging economies have expanded significantly. You can now invest thematically (e.g., digital infrastructure in Asia or green energy in Africa) or broadly (e.g., the MSCI Emerging Markets Index).

Top ETF strategies to consider:

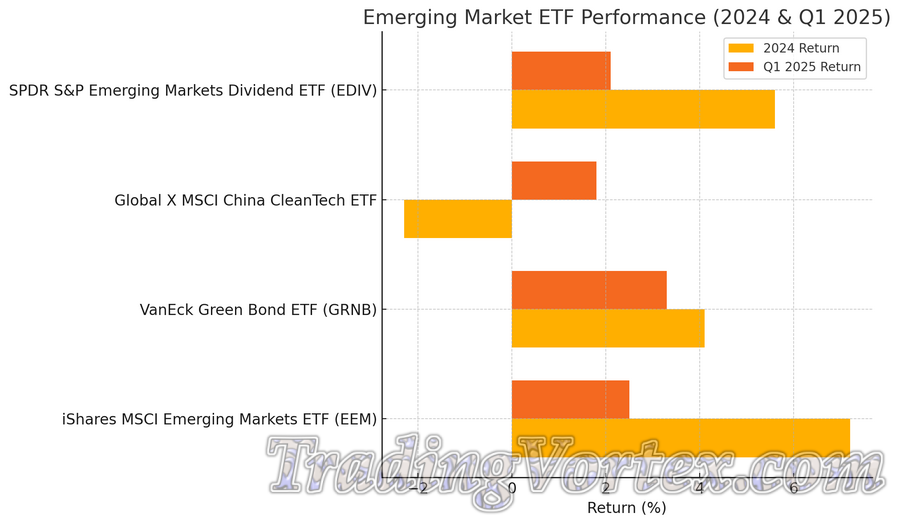

- Broad-market ETFs like iShares MSCI Emerging Markets ETF (EEM) provide diversified exposure across multiple countries and sectors.

- Thematic ETFs such as VanEck Green Bond ETF (GRNB) or Global X MSCI China CleanTech ETF target specific trends within EMs.

- Dividend-focused ETFs like SPDR S&P Emerging Markets Dividend ETF (EDIV) are ideal for those seeking income with some upside.

Benefits of ETF investing in EMs:

- Lower costs and minimal management.

- Instant diversification.

- Easy access to frontier markets otherwise difficult to reach.

Just remember to review each ETF’s holdings, regional exposure, and currency risk. Even passive investors should stay aware of political events or macro changes that could impact entire regions.

Bonus Strategy – Blending Approaches for a Balanced Portfolio:

You don’t have to choose just one strategy. In fact, some of the best-performing portfolios in 2025 are combining momentum trades for short-term gains, long-term value positions for capital appreciation, and ETFs for steady exposure.

For instance, a trader might use technical analysis to catch a rally in Indonesian tech stocks, hedge the currency risk using FX futures, and simultaneously hold an EM consumer growth ETF for long-term exposure.

This kind of hybrid approach offers flexibility and resilience, especially when markets shift unexpectedly.

Final Thoughts – It’s Not About Being Right, It’s About Being Ready:

Emerging markets offer opportunities that you just won’t find in more mature economies. But they demand respect. Things move fast. Sentiment shifts quickly. And sometimes, logic takes a backseat to local politics or global fears.

The good news? With the right strategies, you can navigate the chaos and come out ahead.

- Choose a strategy that fits your personality and time horizon.

- Stay informed about macro trends, political developments, and central bank moves.

- Use strong risk management—because even great strategies need guardrails.

- Be open to adapting. What works in one country or year might not work in another.

And finally, don’t forget to enjoy the ride. There’s something deeply satisfying about discovering opportunity where others only see risk. That’s the beauty of trading emerging markets.

Visual representation of selected Emerging Market ETFs and their performance in 2024 and Q1 2025. This chart can help traders and investors quickly spot which strategies or sectors — such as dividend-focused or green energy ETFs — have been gaining traction recently. It highlights the varied returns across different types of emerging market exposure.

High-Potential Sectors to Watch in Emerging Economies:

When it comes to trading in emerging markets, choosing the right sectors can make all the difference. In 2025, the landscape is shifting fast, and knowing where to look is more valuable than ever. Several industries are showing strong signs of growth, thanks to a mix of local innovation, global demand, and supportive policies. Whether you’re a seasoned investor or just getting started, here are the sectors worth paying close attention to this year.

Natural Resources and Commodities – The Lifeblood of Many Emerging Economies:

Let’s start with a classic. Many emerging markets still lean heavily on commodities — but not in the same old way. The global transition to clean energy is supercharging demand for critical raw materials like lithium, cobalt, and copper. These aren’t just buzzwords; they’re essential components in electric vehicles, batteries, and renewable infrastructure.

Countries like Chile, Indonesia, and the Democratic Republic of Congo are sitting on some of the richest deposits of these minerals. At the same time, traditional commodities such as oil and agricultural goods continue to support export revenues in countries like Nigeria, Brazil, and Argentina.

What traders should watch:

- Government regulations on resource extraction and export

- Global commodity prices, especially those linked to energy and clean tech

- ESG scrutiny and sustainability concerns, which are reshaping investment flows

Quick Tip: Pair commodity exposure with geopolitical analysis. National strikes, export bans, or political instability can drastically shift pricing overnight.

Fintech, E-commerce, and Telecom: The Digital Boomtowns:

If you’ve been following mobile money in Africa or super apps in Southeast Asia, you know digital infrastructure in emerging markets is evolving at lightning speed. Fintech is not just about banking anymore — it’s driving everything from insurance to micro-investments to digital ID verification.

Meanwhile, e-commerce is on fire, especially in regions with a growing middle class and widespread mobile internet. Telecom companies are building out infrastructure to meet demand, often leapfrogging older technologies entirely.

Hotspots in 2025:

- Kenya and Nigeria are leading fintech adoption in Africa.

- India, Vietnam, and the Philippines are expanding digital payment systems at scale.

- Latin America, particularly Brazil and Mexico, are becoming e-commerce powerhouses.

What traders should watch:

- Mobile penetration rates and internet infrastructure expansion

- Regulatory frameworks around data, privacy, and digital finance

- Public-private partnerships driving tech acceleration

Quick Tip: Look for companies providing infrastructure, not just consumer-facing apps. Fiber optics, cloud services, and payment rails are less flashy but often more stable.

Infrastructure and Renewable Energy – Building for the Future:

Emerging economies are undergoing massive transformations in physical and energy infrastructure. From roads and ports to solar farms and wind turbines, governments and investors are pouring capital into development projects that create long-term value.

Why this matters:

- Infrastructure projects can unlock new trade routes and supply chains.

- Renewable energy helps meet climate goals while reducing energy import dependence.

- Green finance and climate-linked investments are opening up massive capital flows.

What traders should watch:

- Sovereign investment plans and foreign direct investment (FDI) trends

- World Bank and IMF infrastructure lending programs

- Local capacity to implement and maintain large-scale projects

Quick Tip: Keep an eye on infrastructure-linked ETFs and green bonds focused on emerging markets.

Financial Services – Reform and Innovation Driving Access:

Financial sectors in emerging economies are seeing major overhauls — and that’s opening up opportunities not just for banks, but also for investors. In India, regulators recently allowed the securitization of distressed assets, creating a new marketplace for high-risk, high-reward debt instruments. In China, the government is opening more doors for foreign firms in the insurance and asset management industries.

At the same time, microfinance institutions and alternative lenders are scaling operations to serve unbanked and underbanked populations.

What makes this sector appealing:

- Rapid digitization of financial services

- Government-led financial inclusion initiatives

- Growth in savings and investment products as incomes rise

What traders should watch:

- Central bank policy changes and regulatory shifts

- Local interest rate environments and inflation pressures

- Corporate debt issuance and credit growth trends

Quick Tip: Consider combining financial sector exposure with consumer trends. Rising middle classes often drive demand for mortgages, insurance, and investment products.

Healthcare and Biotech – A Quiet Yet Powerful Growth Story:

Although not always front and center, healthcare and biotech are emerging as stealthy winners in developing regions. Post-COVID, many countries are investing in healthcare infrastructure, domestic pharmaceutical production, and telehealth systems.

Opportunities in 2025:

- Vaccine and biotech manufacturing hubs in South Asia and Africa

- Digitally enabled health services in underserved areas

- Government spending on public health and emergency preparedness

What traders should watch:

- Global health policy and pandemic preparedness investments

- International partnerships with local health providers

- Export trends in pharmaceuticals and biotech

Quick Tip: Explore companies operating at the intersection of health and tech — from AI diagnostics to logistics for remote clinics.

Final Word – Opportunity Awaits the Prepared:

Emerging markets may not be a one-size-fits-all play, but the sectors outlined above offer a wealth of opportunity for those willing to look closely. Timing, local knowledge, and risk management all matter, but identifying the right industries early can be the difference between a solid return and a missed chance.

Use sector-specific data, track policy changes, and follow regional news closely. And as always, diversify wisely and think long-term when the road looks bumpy. In emerging markets, that road may be rough, but it often leads to gold.

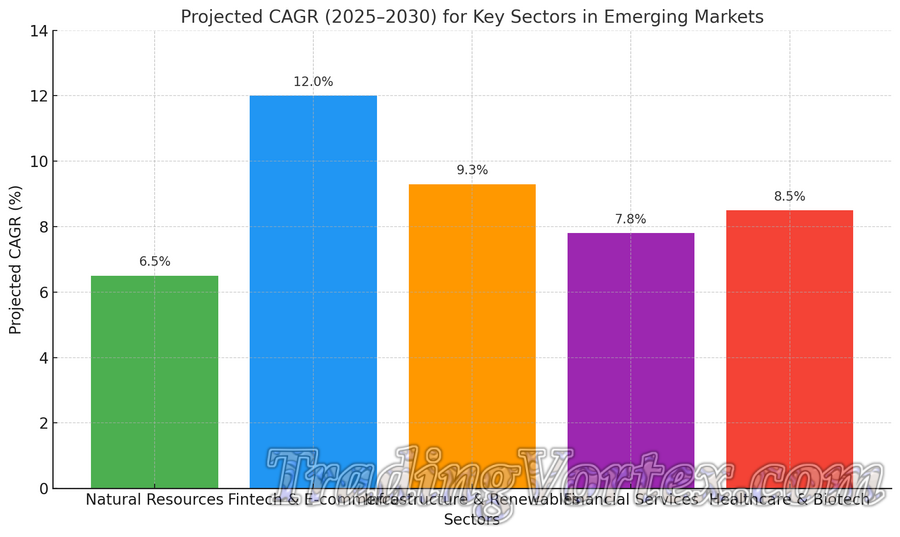

Visual representation showing the Projected Compound Annual Growth Rates (CAGR) from 2025 to 2030 for key sectors in emerging markets. As highlighted in the chart:

♦ Fintech and E-commerce are expected to lead with the highest growth, thanks to rising internet penetration, mobile payment adoption, and a youthful, tech-savvy population.

♦ Infrastructure and Renewables follow closely, driven by large-scale energy transitions and urban development programs.

♦ Healthcare and Biotech also show strong potential as governments increase healthcare investment post-pandemic.

♦ Financial Services and Natural Resources remain crucial pillars, especially in resource-rich and reform-oriented regions.

Managing Risk When Trading Emerging Markets:

Trading in emerging markets presents a thrilling opportunity for high returns, but it also comes with its own set of risks. To navigate this environment effectively, traders need to understand and manage the unique risks that come with emerging market economies. While volatility, political instability, and currency fluctuations can be challenging, smart strategies can mitigate these risks and help you make informed, calculated decisions.

Let’s dive into some of the key strategies to manage risk while trading in emerging markets, and how you can safeguard your investments.

Navigating Low Liquidity and Market Access Barriers:

One of the most significant challenges in emerging markets is the issue of liquidity. Compared to more developed markets, many emerging economies have smaller, less liquid exchanges and fewer institutional investors. This can result in higher bid-ask spreads, which increases transaction costs and makes it harder to execute large trades without impacting market prices. Furthermore, some markets may have limited trading hours or restricted access due to local regulations, adding another layer of difficulty.

How to manage liquidity and access risks:

- Trade liquid instruments: Focus on widely traded assets such as ETFs or bonds that track regional indices. These typically offer better liquidity compared to individual stocks or niche market segments. For example, ETFs like the iShares MSCI Emerging Markets ETF (EEM) allow you to access a broad range of emerging market stocks without the liquidity concerns of single stocks.

- Use limit orders: When trading in less liquid markets, limit orders allow you to control the price at which you buy or sell, ensuring that you don’t suffer from slippage. By setting a price you're comfortable with, you avoid the risks of executing a trade at unfavorable prices due to low market depth.

- Monitor market conditions: Stay updated on local and global news, economic reports, and any changes to market infrastructure. Understanding when liquidity might dry up (such as during political events or major holidays) can help you time your trades better and avoid potential pitfalls.

Protecting Against Currency and Sovereign Risk:

Currency risk is one of the most prominent challenges when trading in emerging markets. Local currencies can be highly volatile due to a variety of factors, including inflation, geopolitical instability, or changes in commodity prices. Sovereign risk, which refers to the risk that a government might default on its debt or implement policies that negatively impact the economy, is another significant concern.

Effective strategies to manage currency and sovereign risks:

- Currency hedging: One of the most common ways to protect against currency risk is to use hedging instruments, such as currency futures, options, or forward contracts. These tools allow you to lock in exchange rates, mitigating the risk of currency depreciation.

- Invest in hard-currency denominated assets: Instead of holding local currency-denominated bonds or stocks, consider assets priced in stable currencies like the U.S. dollar or euro. This can reduce your exposure to sudden currency devaluation.

- Keep an eye on sovereign credit ratings: Rating agencies such as Moody's, S&P, and Fitch provide regular updates on sovereign creditworthiness. Monitoring these ratings can give you early warnings about potential default risks or shifts in government policy that could affect your investments.

- Stay diversified: By spreading your investments across multiple countries and regions, you reduce the impact of a currency crisis in any single nation. For example, balancing your portfolio with investments in both Latin America and Southeast Asia can shield you from local currency volatility in one region.

Diversifying Across Regions and Asset Classes:

Diversification remains one of the most powerful tools in risk management. Emerging markets are subject to a variety of risks, including political unrest, natural disasters, and sudden changes in economic policy. By diversifying across different regions and asset classes, you reduce the impact of any single event or risk factor on your portfolio.

How to diversify effectively:

- Geographical diversification: Instead of concentrating all your investments in one emerging market, consider spreading your risk across multiple regions. For example, you might choose to invest in Africa, Asia, and Latin America, as these regions often have different economic cycles and are influenced by different global factors.

- Asset class diversification: Mixing different types of assets — such as equities, bonds, real estate, and commodities — can help reduce risk. Emerging market bonds, for instance, may provide more stable returns compared to stocks during periods of heightened volatility.

- Investing in emerging market funds: If direct investment in emerging market assets feels too complex or risky, consider low-cost ETFs or mutual funds that track broad emerging market indices. These funds automatically diversify across multiple assets, reducing the risk associated with individual securities.

- Rebalance your portfolio regularly: Market conditions change, so it’s crucial to review and adjust your portfolio on a regular basis. By doing so, you ensure that your diversification strategy remains aligned with your investment goals and the changing global landscape.

Strategic Use of Options, Futures, and Derivatives:

Derivatives, such as options and futures, are often seen as advanced tools in the risk management toolkit. When used correctly, they can help traders mitigate risks and enhance returns. For instance, futures contracts can be used to hedge against potential losses in underlying assets, while options can provide protection against sharp market movements.

How to use derivatives for risk management:

- Hedging with options and futures: If you’re concerned about potential downside risks, using options to buy protective puts or selling futures contracts can help shield your portfolio from large market moves. These strategies can be particularly useful during times of heightened uncertainty in emerging markets, such as during elections or before significant economic announcements.

- Leveraged exposure to emerging markets: Derivatives allow you to take leveraged positions in emerging markets without committing large amounts of capital. However, leverage can magnify both gains and losses, so it’s important to use it cautiously and only when confident in your market view.

- Keep an eye on volatility: Emerging markets can be prone to high volatility, which makes options and futures particularly valuable for traders looking to manage risk. By using these instruments, you can lock in profits or limit losses in a highly volatile environment.

- Professional advice: If you’re new to using derivatives, it’s advisable to consult with a financial advisor or risk management professional. They can help you understand the intricacies of these tools and develop a strategy tailored to your risk tolerance and trading goals.

Final Thoughts:

While trading in emerging markets offers the potential for impressive returns, it’s not without its risks. However, with a solid understanding of how to manage these risks, you can make informed decisions and protect your investments. By using strategies like diversifying your portfolio, hedging currency risk, and strategically employing derivatives, you can navigate the complexities of emerging markets with greater confidence.

Remember, risk management isn't about avoiding risk entirely but about reducing it to a level that fits your investment goals and risk tolerance. Stay informed, stay strategic, and you'll be well-equipped to take advantage of the many opportunities that emerging markets offer.

Chart showing both average currency volatility and sovereign risk ratings across key emerging market regions in 2025. This comparison helps highlight why managing risk is crucial when trading in these environments.

Tools and Technologies for Smarter Emerging Market Trading:

Let’s be real: emerging markets don’t come with a rulebook, and trading them without the right tools can feel like navigating a jungle blindfolded. Thankfully, today's tech isn’t just for Wall Street veterans or algorithmic wizards. It’s increasingly tailored for everyday traders who want smarter, faster, and more informed decisions in regions where volatility and opportunity often go hand in hand.

Let’s explore the key tech allies reshaping how traders navigate emerging markets in 2025.

AI and Machine Learning – Turning Big Data into Actionable Moves:

AI is no longer some sci-fi fantasy or exclusive to hedge funds. It’s now at the fingertips of retail traders who want to process massive amounts of data and identify subtle patterns in price action, volume shifts, and market sentiment.

AI trading tools are also branching into localization, learning the rhythm of specific countries' markets, adjusting for capital controls, political instability, or even unpredictable central bank behavior.

Practical Takeaway: Don’t ignore free or affordable tools like TradingView’s AI-assisted pattern recognition, Tickeron’s AI stock signals, or machine learning bots that help automate portfolio rebalancing. Even basic sentiment indicators pulled from Twitter or Reddit can help gauge risk appetite in certain regions.

Tip: AI isn’t magic. Use it as a support tool, not a replacement for your own market research and instincts.

Mobile and Cloud-Based Trading Platforms – Trade Anywhere, Anytime:

In 2025, cloud-based and mobile platforms aren’t just convenient; they’re essential. Why? Because emerging markets can move fast, and political headlines or central bank interventions don’t wait for you to get back to your desk.

Platforms like eToro, Interactive Brokers, and IG Markets now offer full trading capabilities on mobile. They include live data feeds, integrated news, copy trading, and multi-asset access — all critical for navigating fast-moving events in developing economies.

Cloud computing also means more secure, scalable environments for storing your trade setups, historical data, and strategies. Plus, they allow real-time syncing across devices, so you never miss a beat whether you're in an airport lounge in Nairobi or at a café in Buenos Aires.

Localized Data Feeds and Regional News Aggregators – Your Window into the Market Mood:

Tools like Koyfin, TradingEconomics, and regional aggregators such as AfricaReport, LatinFinance, or The Ken (for India) provide timely, contextual updates that matter for EM-focused traders.

Also, keep an eye on apps and platforms that incorporate natural language processing to track and summarize regional news sentiment. They help you decode the tone and weight of news beyond just headlines.

Warning: Relying solely on global feeds can result in missing key domestic developments. Localization isn't optional. It’s essential.

Real-Time Analytics – The Engine Behind Smarter Risk and Opportunity Management:

In emerging markets, you need to react fast. That’s where real-time analytics tools shine. These tools do the heavy lifting; whether it's tracking volatility spikes, monitoring correlation shifts, or identifying unusually high trading volumes in niche ETFs.

From risk dashboards in MetaTrader 5 and Thinkorswim to customizable analytics in QuantConnect and TradeStation, the focus in 2025 is on fast interpretation and customizable visualization. No more guessing. You can now quantify geopolitical risk, liquidity risk, or even ESG risk on demand.

Want to trade a South African bank stock but worried about currency fluctuations? Real-time models can run simulations based on ZAR movements and flag optimal hedge opportunities.

Pro Insight: Combine analytics with historical context. Just because something looks attractive on a chart doesn’t mean it makes sense within the broader macro narrative.

Bonus – Social Trading and Community Insights:

While not exactly “tech” in the traditional sense, the rise of social trading platforms deserves a mention. Platforms like ZuluTrade, Public, and eToro allow you to copy experienced traders or follow region-specific strategies. This is especially helpful in emerging markets, where experienced local traders often have a better read on unpredictable scenarios.

Community-driven tools like Reddit’s r/emergingmarkets or X (formerly Twitter) trading threads also offer real-time crowd sentiment. When paired with real data, this can give you an edge in anticipating short-term sentiment shifts.

Summary Table – Essential Tools for EM Traders in 2025:

| Tool Type | Example Platforms | Key Benefit for EM Traders |

|---|---|---|

| AI & ML Tools | DeepSeek, Tickeron, Trade Ideas | Predictive signals and advanced pattern recognition |

| Cloud/Mobile Trading | eToro, IBKR, IG, Saxo | Full-featured trading access on the go |

| Local News Aggregators | AfricaReport, The Ken, Koyfin | Informed decisions based on regional insights |

| Real-Time Analytics | MetaTrader 5, QuantConnect | Immediate risk tracking and opportunity identification |

| Social Trading Platforms | ZuluTrade, eToro, Public | Strategy sharing and sentiment discovery |

Final Thought:

You don’t need every tool in the toolbox, but you do need the right ones for your goals and style. If you're short-term trading, prioritize real-time analytics and news aggregators. If you’re in for the long haul, AI and machine learning can help fine-tune your edge. And if you're always on the move, cloud platforms are non-negotiable.

Emerging markets are wild, exciting, and full of promise. With the right technology, you're no longer reacting to the market — you’re anticipating it.

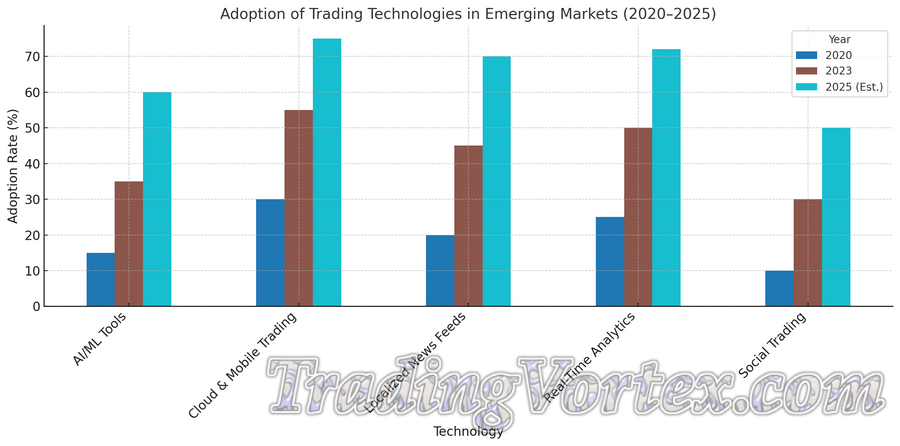

Chart showing the rising adoption of key trading technologies in emerging markets between 2020 and 2025 (estimated). It highlights how tools like AI, mobile platforms, and real-time analytics are becoming essential for smart trading in these dynamic economies.

Regional Spotlights: Where to Focus in 2025?

Emerging markets are rarely a one-size-fits-all game. Each region offers its own mix of risks, rewards, and rhythms. In 2025, macroeconomic shifts, demographic trends, and geopolitical realignments are reshaping where investors should pay the most attention. Let’s dive into the most promising regions and break down what’s really happening on the ground.

Latin America – Commodities, Inflation, and Structural Reform:

Latin America is once again in the spotlight, largely thanks to its critical role in the global commodities cycle. With copper, lithium, soybeans, oil, and natural gas in high demand, resource-rich economies like Brazil, Chile, and Peru are seeing renewed interest from global traders. But the real story isn’t just about natural resources — it’s also about economic reform.

Brazil, Latin America's largest economy, is experiencing steady progress in monetary policy and energy transition. The country is balancing traditional exports like oil and iron ore with investments in biofuels and green hydrogen. Meanwhile, Chile, which holds the world’s largest lithium reserves, is reforming its mining sector to strike a balance between state involvement and foreign investment.

Elsewhere, Mexico is benefiting from the “nearshoring” wave, as companies shift production closer to U.S. consumers. Its manufacturing sector is booming, and investors are keeping a close eye on the Mexican peso as a barometer for trade flows and interest rate policies.

Argentina, long plagued by economic instability, is once again attempting a structural turnaround with its new government pushing market-friendly policies. Whether that translates into sustainable reform or just another cycle of hope remains to be seen.

Investor takeaway: Latin America offers exposure to commodities, manufacturing, and policy-led recovery. But beware of currency volatility and inflation flare-ups. A diversified approach, including ETFs and hedging tools, can help manage these risks.

Southeast Asia – Manufacturing, Digital Expansion, and a Rising Middle Class:

If Latin America is the play for raw materials, Southeast Asia is the bet on digital growth and industrial resilience. The region is fast becoming a key node in the global supply chain, thanks to competitive labor markets, improving infrastructure, and pro-investment policies.

Vietnam continues to punch above its weight, thriving as a go-to alternative to China for tech manufacturing. Its GDP growth is projected to remain above 6% this year, driven by electronics, garments, and robust FDI inflows. Meanwhile, Indonesia is emerging as a leader in electric vehicle supply chains, thanks to its rich nickel reserves and proactive government partnerships.

The Philippines, with its young, tech-savvy population, is seeing growth in business process outsourcing, e-commerce, and fintech. And Thailand is quietly attracting capital through its medical tourism and automotive sectors.

Digital adoption is soaring across the region. Smartphone penetration, mobile wallets, and digital banks are creating new ways for people to save, spend, and invest — and that's a game-changer for consumer-facing businesses.

Investor takeaway: Southeast Asia is ideal for traders seeking exposure to tech, consumer growth, and evolving manufacturing hubs. Keep an eye on interest rate differentials and regional trade policies when assessing risk.

Sub-Saharan Africa – Youth, Urbanization, and Infrastructure Momentum:

Sub-Saharan Africa is where patience meets potential. This region boasts the world’s youngest population and fastest urbanization rates. But it’s not just about the long-term demographic dividend — there are immediate investment themes emerging, especially around infrastructure and fintech.

Kenya remains a standout for digital finance, thanks to M-Pesa and a flourishing mobile banking ecosystem. Nigeria, despite facing macroeconomic challenges, is nurturing a dynamic tech startup scene in Lagos and attracting capital in agritech and payment solutions. Meanwhile, Ethiopia and Tanzania are investing heavily in road and energy infrastructure to unlock trade and industry.

From renewable energy to water systems and transport corridors, infrastructure investment is reshaping growth prospects. The World Bank and African Development Bank continue to support high-impact projects, and several governments are prioritizing public-private partnerships.

Of course, risks remain. Sovereign debt levels, currency weakness, and governance issues still pose challenges. However, the rise of local capital markets and fintech ecosystems is helping reduce reliance on traditional financial intermediaries.

Investor takeaway: Africa is not just a humanitarian story — it’s an emerging market story. Look for opportunities in infrastructure ETFs, frontier market funds, and private equity platforms that specialize in the region.

Eastern Europe – Recovery, Reconstruction, and Resilience:

It’s impossible to talk about Eastern Europe without addressing the ongoing impact of Russia’s invasion of Ukraine. Yet, even in the midst of conflict and uncertainty, parts of the region are showing unexpected economic resilience.

Poland continues to lead in terms of foreign direct investment, driven by its skilled workforce and proximity to Western European markets. It's a hub for logistics, IT services, and manufacturing. EU support remains strong, and investors are eyeing Poland as a key beneficiary of reshoring and defense spending.

Romania and Hungary are navigating inflation and monetary tightening but remain attractive for tech outsourcing and industrial production. The Baltics, despite being small, are resilient digital economies with high levels of innovation and digital government services.

Ukraine, though still at war, is laying the groundwork for long-term reconstruction, backed by international financial support. It’s early days, but the long-term rebuild could be one of the largest economic opportunities in Europe post-WWII.

Investor takeaway: Eastern Europe offers selective opportunities for risk-tolerant investors. Focus on funds or instruments with targeted exposure to reconstruction, logistics, and defense infrastructure.

Summary Table – Regional Outlook for 2025:

| Region | Key Opportunities | Primary Risks | Notable Markets |

|---|---|---|---|

| Latin America | Commodities, energy transition, reforms | Inflation, political instability | Brazil, Mexico, Chile |

| Southeast Asia | Tech manufacturing, fintech, consumption | Currency swings, trade policy shifts | Vietnam, Indonesia |

| Sub-Saharan Africa | Infrastructure, digital finance, youth | Sovereign debt, liquidity constraints | Kenya, Nigeria, Ethiopia |

| Eastern Europe | EU integration, reconstruction, logistics | Geopolitical conflict, inflation | Poland, Romania, Ukraine |

Final Thoughts:

The best emerging market strategies start with knowing where to look. Each region comes with its own narrative, risks, and potential catalysts. Whether you're building a portfolio, fine-tuning a trading strategy, or just scouting new opportunities, understanding these regional spotlights gives you an edge in a market where headlines often mask the real momentum.

Institutional and Expert Perspectives:

In a world where volatility is the norm and certainty is scarce, it helps to see how the big players operate. Institutional investors, hedge funds, global banks, and economic organizations like the IMF and World Bank spend millions on research, talent, and data to figure out where the puck is headed in emerging markets. While you might not have their budget or army of analysts, their insights are a goldmine for any trader — whether you’re a beginner or managing a serious portfolio.

Let’s break down what these institutions are focusing on in 2025, and more importantly, how you can use that knowledge to make better trading decisions.

How Hedge Funds and Asset Managers Navigate Emerging Markets:

For hedge funds and asset managers, 2025 is shaping up to be a year of tactical moves and smarter risk-taking. According to BlackRock’s latest Emerging Markets Outlook, institutional investors are reallocating toward markets with improving real yields, stable fiscal outlooks, and proactive central banks. India, Brazil, and Indonesia are getting special attention, not just because of macro stability but also because of structural reforms that promise long-term growth.

What’s interesting is how these funds approach risk. Instead of avoiding volatility, they embrace it — with strict controls. Many are using long-short strategies to hedge political risk, or engaging in currency carry trades when local central banks are ahead of the curve.

Others are rotating between sectors based on global macro shifts: for example, moving into commodities when the dollar weakens, or pivoting to consumer tech when domestic demand strengthens.

Even more fascinating is their increasing use of alternative data. Some hedge funds track satellite imagery of port traffic to anticipate trade bottlenecks. Others analyze mobile phone penetration or nighttime lights in rural areas to gauge real economic activity. It sounds fancy, but the logic is straightforward: more data, better decisions.

Insights from the IMF, World Bank, and MSCI:

Unlike hedge funds, multilateral institutions aren’t trading for profits. They’re trying to build sustainable growth in emerging economies. That said, their insights are incredibly relevant to traders because they often highlight where capital is likely to flow next.

The IMF’s 2025 Global Economic Outlook notes that domestic demand is replacing exports as the main growth engine in many emerging economies, especially in South Asia and parts of Sub-Saharan Africa. This is a shift from the old export-led model, and it has implications for everything from consumer goods to infrastructure.

The World Bank has flagged digital financial inclusion, energy access, and climate resilience as three core pillars of its development strategy. For investors, this means fintech, green energy, and logistics infrastructure will likely see increased support and investment. Following the money here can reveal powerful long-term opportunities.

MSCI’s latest Emerging Markets Index adjustments tell their own story. India and Saudi Arabia are gaining greater weight due to investor confidence and reforms, while Turkey and Argentina are seeing downgrades because of policy instability and inflation concerns. Watching how MSCI adjusts its exposure is like getting a front-row seat to institutional sentiment shifts.

Blending Global Insights with Local Intelligence:

Institutions have long understood that to succeed in emerging markets, you can’t just rely on Bloomberg terminals and economic models from New York or London. You need real insight from the ground. That’s why global investors are increasingly partnering with local data providers, hiring region-specific analysts, and using natural language processing to analyze news in local languages.

Retail traders can take a page from this playbook. Start by following regional news sources, use platforms that offer local economic indicators, and get familiar with cultural and political nuances. For example, in some countries, election cycles or religious holidays significantly impact trading volumes and consumer spending.

Also, watch for local tech adoption. Emerging markets often leapfrog stages of development. Many went from unbanked to mobile banking in just a few years. Understanding these dynamics helps identify next-generation sectors before they hit the mainstream radar.

Table: What Top Institutions Are Watching in 2025?

| Institution | Focus Regions | Key 2025 Themes |

|---|---|---|

| BlackRock | Brazil, India, Indonesia | Local-currency debt, ESG, monetary easing cycle |

| Goldman Sachs | Vietnam, South Africa, Mexico | Currency trades, frontier equity markets, inflation hedging |

| IMF | South Asia, SSA, MENA | Domestic demand, debt sustainability, fiscal reforms |

| World Bank | Africa, Southeast Asia | Infrastructure, climate finance, energy access |

| MSCI | India, Saudi Arabia | Index weight increase, corporate governance, tech exposure |

Final Thought:

The strategies and forecasts coming out of major institutions aren't just ivory tower theory. They are blueprints shaped by some of the smartest minds with access to data we can only dream of.

But here’s the real kicker: you don’t have to mimic their portfolios to benefit. You just need to align your thinking with the same trends.

If the World Bank is pouring resources into fintech in East Africa, or if MSCI is overweighting Indian equities, ask yourself what that means for local consumer behavior, supply chains, and investor sentiment. Read the footnotes, track fund flows, and pay attention to policy changes. Over time, these patterns start to click, and suddenly you’re not just reacting to the market — you’re moving with it.

That’s the edge. And in emerging markets, where every edge counts, it could make all the difference.

Final Thoughts and Key Takeaways:

How to Stay Ahead in Emerging Market Trading in 2025:

Let’s be honest: emerging markets aren’t for the faint of heart. But if you’re willing to put in the effort, 2025 could be full of real opportunities. With global growth slightly below historical trends, developed economies might look a bit sluggish. But emerging economies? They’re holding their own and, in some cases, surging ahead.

Take India, for example. It’s not just growing; it’s charging forward with reforms, domestic demand, and infrastructure investment that are turning heads globally. Meanwhile, Latin American countries are leaning into reforms and green energy, and Southeast Asia continues to attract global manufacturing as companies diversify away from China.

So, how do you keep up? Here are a few things to prioritize:

- Stay Curious, Stay Current: The moment you tune out of macroeconomic and political developments, the market will remind you why that’s a bad idea. Stay plugged into regional updates, global data, and central bank moves.

- Lean Into Agility: The beauty (and pain) of emerging markets is their unpredictability. What worked last quarter may fall flat today. Be ready to pivot — and keep some dry powder for sudden opportunities.

- Use the Tools: You’re not trading in 2005 anymore. AI-driven platforms, mobile dashboards, and localized data feeds make it easier than ever to trade smart. Don’t ignore the tech. Embrace it.

Adapting Strategies to Changing Geopolitical and Economic Landscapes:

No one needs to remind traders how sensitive emerging markets can be to global power plays. In 2025, this is especially true. Ongoing tensions between China and the West, regional conflicts, central bank divergence, and election cycles across the globe are reshaping capital flows.

Here's what adaptive strategy actually looks like:

- Think in Scenarios: Build your strategy around “what if” pathways. What if U.S. rates remain higher for longer? What if commodity prices swing wildly? Preparing for multiple outcomes builds confidence and flexibility.

- Recalibrate Often: Don’t just set a strategy and forget it. Re-evaluate your positions regularly based on local fiscal health, monetary policy, and currency exposure. A country that was hot six months ago might be cooling rapidly.

- Local Intelligence is Gold: Use sources that go beyond headlines. Tap into regional news outlets, analyst reports from local banks, and economic data from government and private agencies. Global headlines miss the nuance.

Summary: What Every Trader Needs to Know Now?

Let’s bring it all together. Emerging markets in 2025 are not just a niche for adventurous traders. They’re a key part of any well-rounded portfolio. The volatility may scare off the timid, but for those who learn the rhythm of these markets, the rewards can be substantial.

Here’s a quick list of takeaways to keep in your trading toolkit:

| Strategy Pillar | Why It Matters |

|---|---|

| Diversify Regionally & Sectorally | Avoid concentration risk. Spread across regions and industries. |

| Use Currency Hedging Tools | FX swings can wipe out profits. Hedging is a must in volatile regions. |

| Watch the News — But Read Deeper | Surface headlines miss nuance. Local insight can give you the edge. |

| Adapt to Policy Shifts Quickly | Don’t cling to outdated narratives. Markets are moved by fresh signals. |

| Think Long-Term | EM trades aren’t always overnight wins. Patience and context matter. |

At the end of the day, trading emerging markets is as much about mindset as it is about method. The chaos, the contradictions, the explosive potential — they’re all part of the experience. If you come prepared with insight, strategy, and a healthy respect for risk, these markets can become not just places to trade, but places to grow.

Frequently Asked Questions (FAQs):

Q1. What exactly are emerging markets, and why do traders care so much?

Emerging markets are economies that are not yet fully developed but are growing fast. Think Brazil, India, Vietnam, or South Africa. These countries often have expanding middle classes, increasing industrial activity, and a surge in infrastructure investment. Traders love them because they tend to offer stronger growth prospects than more mature markets. But—and this is key—that also means more volatility and unpredictability. It's a high-reward, high-risk environment. If you like a bit of calculated adventure in your trades, emerging markets can be your playground.

Q2. Which regions should I keep an eye on in 2025?

In 2025, several hotspots are catching the market’s attention:

♦ India continues to be a magnet for long-term capital. Its digital economy, manufacturing boom, and strong domestic consumption make it a standout.

♦ Brazil is bouncing back, helped by its commodity exports and political efforts to stabilize inflation. Traders are watching agribusiness, energy, and infrastructure.

♦ Vietnam and Indonesia are gaining from shifting global supply chains. With rising labor costs in China, multinationals are doubling down in Southeast Asia.

♦ Kenya and Nigeria are fast becoming fintech pioneers in Africa, supported by a young population and digital payment ecosystems.

♦ Poland and Romania, despite the regional instability, are benefiting from EU funding and growing demand for nearshoring production.

These regions offer very different stories, which is part of what makes emerging markets exciting. You can find opportunity in growth, recovery, or reform — sometimes all three at once.

Q3. What trading strategies tend to work best in these markets?

Emerging markets often require a different playbook. Some proven strategies include:

♦ Momentum trading, especially in tech, renewables, and financial sectors where capital flows in rapidly when investor confidence spikes.

♦ Carry trades, where traders take advantage of higher interest rates in EMs relative to developed economies. But currency fluctuations can be wild, so risk management is essential.

♦ Thematic investing, like focusing on clean energy in Latin America or digital finance in Africa, can be a more structured way to ride long-term trends.

♦ Using ETFs and index funds to get diversified exposure when you want access but don't feel comfortable picking individual stocks.

You’ve got to tailor your approach based on the country, sector, and your risk tolerance. What works in Chile may flop in Turkey.

Q4. How do global events affect emerging market trading?

In one word? Drastically. Emerging markets are more exposed to global turbulence because many rely on exports, foreign investment, or external debt. So when something major happens — like a Fed rate hike, an oil price surge, or geopolitical conflict — it hits these markets fast and hard.

In 2025, for instance, changing US-China dynamics, shifts in commodity prices, and currency fluctuations are all shaping EM capital flows. Being tuned in to macroeconomic and political trends isn’t optional, it’s part of the game.

Q5. What risks should I be most aware of?

Here’s the honest truth: emerging markets can surprise you—and not always in a good way. Risks include:

♦ Currency volatility, where sharp swings in exchange rates can wipe out gains quickly.

♦ Political instability, like surprise elections, social unrest, or sudden changes in regulation that can disrupt business conditions.

♦ Liquidity issues, especially in smaller markets, where it might be hard to exit a position without moving the price.

♦ Regulatory unpredictability, where a government might impose capital controls or tax changes overnight.

The trick is to stay diversified, use stop-loss orders wisely, and never invest more than you can afford to lose. Always trade with a parachute.

Q6. What platforms or tools can help me trade smarter?

Technology is your best ally here. Some go-to tools for serious EM traders include:

♦ Mobile-friendly brokerage platforms like Interactive Brokers or Saxo Bank, which offer wide access to international markets.

♦ Localized news feeds through services like EMIS or regional financial blogs, which provide on-the-ground updates often missed by global outlets.

♦ AI-powered research tools like Koyfin or Sentieo, which can analyze sentiment, spot trends, and help predict market shifts based on data, not gut feeling.

♦ IMF and World Bank dashboards, which are underrated sources for macro-level insight and projections.

If you're trading EMs in 2025 without leveraging good tech, you're flying blind. Smart traders automate alerts, aggregate data feeds, and stay mobile-ready.

Q7. How do I keep up with trends and updates without getting overwhelmed?

It can feel like drinking from a firehose sometimes, but there are ways to stay sharp:

♦ Follow dedicated EM analysts and institutions on X (formerly Twitter), LinkedIn, or Substack.

♦ Subscribe to specialized newsletters like those from EM-focused asset managers or global macro analysts.

♦ Bookmark a handful of reliable sources and check them daily — Bloomberg Emerging Markets, Reuters, and regional economic think tanks are a solid start.

♦ And don’t underestimate podcasts and YouTube channels. Some of the best takes on market dynamics come from independent voices sharing deep-dive insights in plain English.

Build a content habit that fits your schedule. A few minutes a day beats a once-a-month panic scroll.