Table Of Contents:

- Introduction: Why Emerging Market ETFs Are Gaining Attention?

- What Are Emerging Market ETFs and Why Should You Care?

- Top Trends Shaping Emerging Market ETF Investing in 2025:

- Smart Strategies to Diversify with Emerging Market ETFs:

- Risk Management in Emerging Market ETF Investing:

- Best Emerging Market ETFs to Watch in 2025:

- ESG Investing in Emerging Markets – A Growing Priority:

- Conclusion – Building a Future-Ready Portfolio with Emerging Market ETFs:

- Frequently Asked Questions – Navigating Emerging Market ETFs:

- Q1. What exactly are Emerging Market ETFs?

- Q2. Why should I consider adding them to my portfolio?

- Q3. What are the key risks involved?

- Q4. How do I choose the right ETF?

- Q5. Are there tax implications?

- Q6. How can I manage the risks?

- Q7. Can I include Emerging Market ETFs in my retirement account?

- Q8. How do currency fluctuations affect performance?

- Q9. Are ESG-focused Emerging Market ETFs worth considering?

- Q10. How do I stay informed about these markets?

Introduction: Why Emerging Market ETFs Are Gaining Attention?

Let’s be honest; most people’s portfolios are overloaded with the usual suspects: U.S. stocks, maybe some bonds, and a sprinkle of tech giants for that “growth” flair. But as we cruise through 2025, a lot of smart investors are asking a new question: "What else is out there?"

The answer, increasingly, is emerging market ETFs. These funds are pulling in attention, and capital, for good reasons. They’re not just a trendy buzzword or a gamble on developing countries anymore. They’ve become a strategic piece of a modern, forward-thinking investment portfolio.

Let’s break down what’s fueling this surge in interest and why this might be the right time to take a closer look.

What Makes Emerging Markets a Key Opportunity in 2025:

Countries like India, Indonesia, Mexico, Vietnam, and parts of Africa are becoming global growth engines. Take India, for example: with a massive domestic market, booming digital economy, and supportive government policies, it has weathered global headwinds better than many developed nations. The Reserve Bank of India even noted recently that India is "less vulnerable to global shocks," which is music to any risk-conscious investor’s ears.

Another key point: valuations are attractive. While U.S. markets are flirting with all-time highs, many emerging markets are still trading at a discount. That means you’re not just chasing growth: you’re buying it at a better price. Lower valuations can also serve as a buffer during downturns, giving emerging markets an added edge when volatility strikes.

And let's not forget demographics. Most emerging markets are young, urbanizing, and digitally connected. That translates into rising consumption, innovation, and infrastructure demand; all powerful drivers for long-term growth.

Why ETFs Are a Smart Way to Diversify Your Portfolio:

So we’ve established that emerging markets look good on paper. But how do you actually invest in them without booking a flight to Jakarta or buying stocks in a language you can’t read?

In 2025, ETFs have become smarter, cheaper, and more accessible than ever. Many now come with ultra-low fees, tight bid-ask spreads, and real-time trading. There are also ETFs tailored to specific strategies. Want to bet on tech growth in Asia? There’s an ETF for that. Interested in frontier markets like Nigeria or Bangladesh? There’s one for that too.

And if you’ve ever worried about transparency or liquidity, modern ETFs have come a long way. You can track holdings in real time, and most popular emerging market ETFs have solid daily trading volumes, making it easy to enter or exit your positions without headaches.

The Growing Importance of Global Diversification:

Let’s zoom out for a second. The past few years have shown us how interconnected the world really is. Whether it’s supply chains, trade wars, pandemics, or interest rate policies, what happens in one part of the world now ripples everywhere.

That’s why diversification is more than just a buzzword: it’s essential.

Relying solely on developed markets like the U.S. or Europe means tying your portfolio to their specific risks, like rising interest rates, slowing tech earnings, or political gridlock. Emerging markets, in contrast, often follow different economic cycles. When the U.S. market cools, some emerging economies might just be heating up.

There’s also the benefit of currency exposure. As the U.S. dollar softens and trade routes shift, some emerging market currencies are becoming more stable and potentially even appreciating. That’s another layer of return, if managed well, that developed markets can’t always provide.

The bottom line? Adding emerging market ETFs to your mix spreads out your risk while tapping into a whole new set of growth engines. It’s like upgrading your portfolio from local roads to the global highway.

Final Thoughts – Time to Look Beyond the Usual:

Whether you’re a seasoned trader or someone just dipping your toes into global markets, emerging market ETFs offer something real – not just hype, but a solid, data-backed opportunity to grow and diversify.

Sure, there are risks (we’ll cover those in another section), but with the right strategy and tools, emerging markets can do more than just spice up your portfolio. They can play a central role in preparing for whatever comes next.

Because let’s face it – the world is changing fast. It’s time our portfolios did too.

What Are Emerging Market ETFs and Why Should You Care?

If you’ve ever looked at your investment portfolio and thought it could use a bit more edge, you’re not alone. The reality is that many portfolios lean heavily toward developed markets, especially the United States. That’s understandable. The U.S. has historically delivered strong returns. But in a globalized economy, relying too heavily on any one region can leave you exposed to its specific risks.

This is where emerging market ETFs enter the conversation. They’re increasingly recognized not just as growth vehicles but as essential tools for long-term portfolio resilience and diversification.

Let’s take a closer look at what they are, how they work, and why they might deserve a place in your portfolio.

Understanding Emerging Market ETFs:

What Exactly Is an Emerging Market ETF?

What makes ETFs especially popular is their accessibility. You can buy and sell them just like individual stocks on a major exchange. No need to open foreign brokerage accounts or navigate international paperwork. They’re transparent, relatively low-cost, and easy to trade.

Common countries featured in these ETFs include India, Brazil, Mexico, South Africa, Indonesia, Vietnam, and Saudi Arabia, among others. The specific mix depends on the ETF you choose and the index it follows.

Broad vs. Sector-Specific: What’s the Difference?

Emerging market ETFs come in two main styles:

- Broad-Based ETFs: These provide diversified exposure across multiple sectors and countries. They are ideal for investors seeking a general position in emerging markets without betting on a specific theme. Examples include the iShares MSCI Emerging Markets ETF (EEM) and Vanguard FTSE Emerging Markets ETF (VWO).

- Sector or Country-Specific ETFs: These allow investors to zoom in on specific opportunities. For instance, if you believe the technology sector in Asia will outperform, you might look at a fund like iShares MSCI Emerging Markets Asia ETF. Similarly, if you’re bullish on just one country like India, there are ETFs focused solely on Indian equities.

Benefits of Investing in Emerging Markets:

Stronger Growth Potential Than Developed Markets:

Emerging economies often deliver higher GDP growth rates than developed countries. According to the International Monetary Fund (April 2025), emerging and developing economies are projected to grow at an average annual rate of 3.9%, compared to only 1.7% for advanced economies. This differential matters. Over time, higher growth can translate into increased corporate earnings and stronger equity returns.

For investors looking for returns that outpace inflation and low-yield bonds, emerging markets offer compelling long-term potential.

Rising Middle Class and Urbanization:

One of the strongest long-term investment themes is the rise of the global middle class, especially in Asia and Africa. As incomes rise, so does consumer spending, particularly in areas like healthcare, education, housing, and technology.

Urbanization is another key theme. As more people move from rural areas to cities, demand increases for transportation, housing, internet access, and public services – all of which support sustainable growth across multiple industries.

Forward-Looking Economic Forecasts:

The economic future of emerging markets varies by region, but several trends are worth noting in 2025:

- India continues to outperform, supported by resilient domestic consumption and favorable fiscal policies. It remains a favorite among global fund managers looking for stable, long-term growth in Asia.

- Vietnam and Indonesia are benefiting from shifting supply chains and foreign direct investment, especially as companies diversify away from China.

- Latin America, particularly Mexico, is gaining attention due to nearshoring trends, though the World Bank recently revised its 2025 GDP growth outlook for the region to 2.1%, down from 2.5%, due to global uncertainties.

Not all forecasts are rosy, of course. Political risks, currency volatility, and commodity price swings still pose challenges. However, for many investors, these risks are worth managing given the relative upside potential and diversification benefits.

Why You Should Care? Even If You’re a Cautious Investor:

Now, you might be thinking: “This sounds interesting, but aren’t emerging markets risky?”

The answer is yes – and no. While it's true that emerging markets can be more volatile, the structure of an ETF helps spread that risk across multiple companies and countries. You’re not putting all your eggs in one geopolitical basket.

In other words, you’re taking on calculated risk with the goal of tapping into markets with better growth prospects. And if your portfolio is heavily weighted toward developed markets, adding emerging market ETFs can smooth out your returns over time. This is diversification in action – not just by sector, but by geography and macroeconomic exposure.

Final Thoughts – A Smarter, Simpler Way to Expand Your Horizons:

Emerging Market ETFs offer an easy, affordable, and transparent way to tap into the parts of the world that are moving fast; and sometimes moving ahead. Whether you’re a new investor looking to go global or a seasoned trader rebalancing a mature portfolio, these ETFs allow you to diversify intelligently without complicating your investment process.

With the right research and a clear understanding of your own risk tolerance, Emerging Market ETFs can be more than just a footnote in your portfolio. They can be a strategic core.

Are you ready to step beyond the familiar and explore what the future of investing could look like?

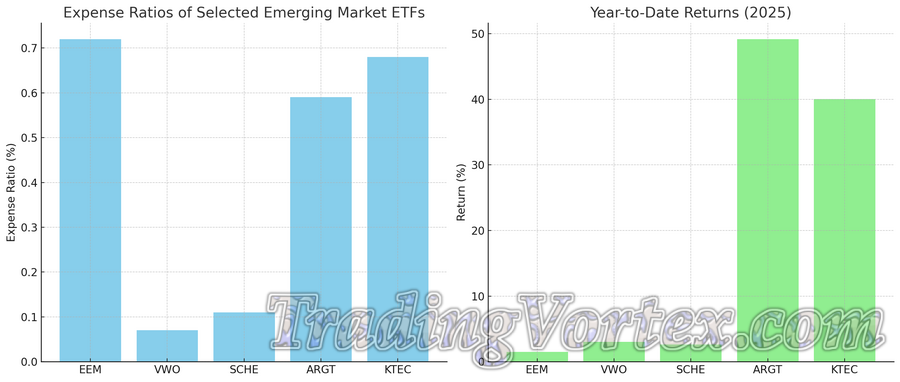

Comparing Cost and Performance: Top Emerging Market ETFs in 2025.

♦ The first chart shows the expense ratios of selected Emerging Market ETFs. This is a crucial factor for long-term investors since high fees can erode gains over time.

♦ The second chart highlights their year-to-date (YTD) returns for 2025, offering a quick look at performance in the current market environment.

Top Trends Shaping Emerging Market ETF Investing in 2025:

Capital Flows and Global Investment Shifts:

How Tariff Fears Are Redirecting Global Capital:

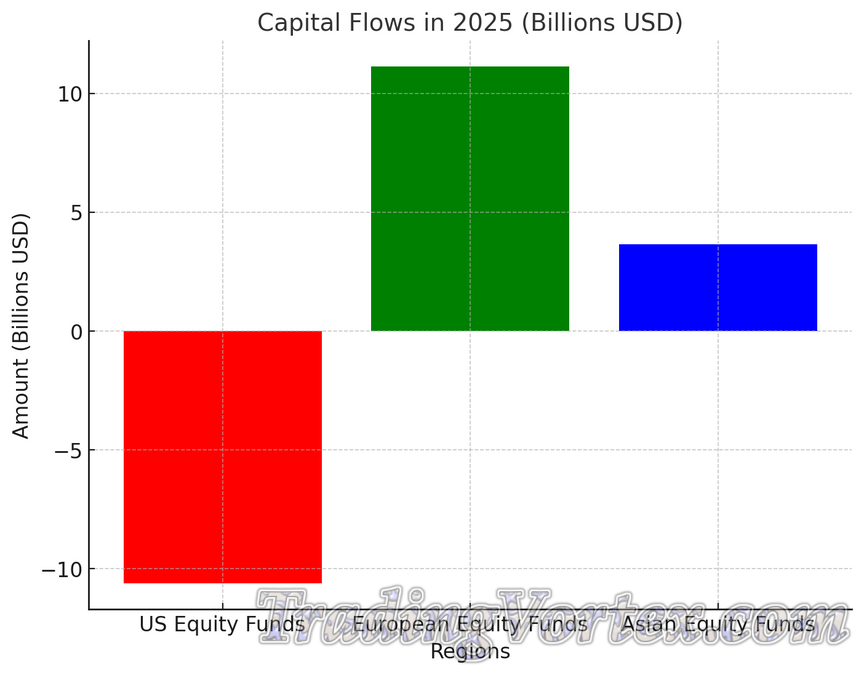

In recent years, the global economy has been shaped by shifting trade dynamics, with tariff concerns and trade wars redirecting capital flows. As geopolitical tensions continue, tariffs and trade restrictions are no longer just theoretical risks but real concerns that influence the movement of capital globally. According to recent data, global capital flows are increasingly favoring emerging markets as investors look for alternative destinations to avoid the disruptions caused by tariffs, particularly those involving the U.S. and China.

In 2025, emerging markets are experiencing a resurgence of foreign investment, with countries such as India and Brazil emerging as favored alternatives. This shift is not just about cost-effectiveness but also about market potential. Tariff fears, coupled with the search for new avenues of growth, are making emerging markets an increasingly attractive destination for global funds.

As tariffs affect global supply chains, emerging markets — especially those in Asia and Latin America — are benefiting from increased diversification of production and investment. By spreading investments across various regions with less direct exposure to tariff-heavy economies, investors can hedge against the risks of tariff escalation in the developed world.

Emerging Markets as a New Destination for Global Funds:

Emerging markets have long been seen as high-risk, high-reward investment opportunities, but in 2025, these markets are positioning themselves as a stable and promising alternative. A key factor driving this shift is the improvement in economic fundamentals in regions like Southeast Asia, Sub-Saharan Africa, and Latin America. As developed economies struggle with slow growth and rising inflation, emerging markets are benefiting from a combination of young, growing populations, expanding middle classes, and increasing domestic consumption.

This transition is reflected in the performance of various emerging market ETFs, which have been outperforming their developed-market counterparts. A prime example is the Vanguard FTSE Emerging Markets ETF (VWO), which has seen a steady increase in inflows. Investors are recognizing the strong fundamentals of countries like India, which continues to see GDP growth rates outpacing those of the U.S. and the EU. In addition to growth, the rise of sustainability initiatives, increased political stability, and the maturation of infrastructure in several regions are also contributing to the increasing appeal of these markets.

Currency Trends and Valuation Opportunities:

Why Emerging Market Currencies May Be Undervalued:

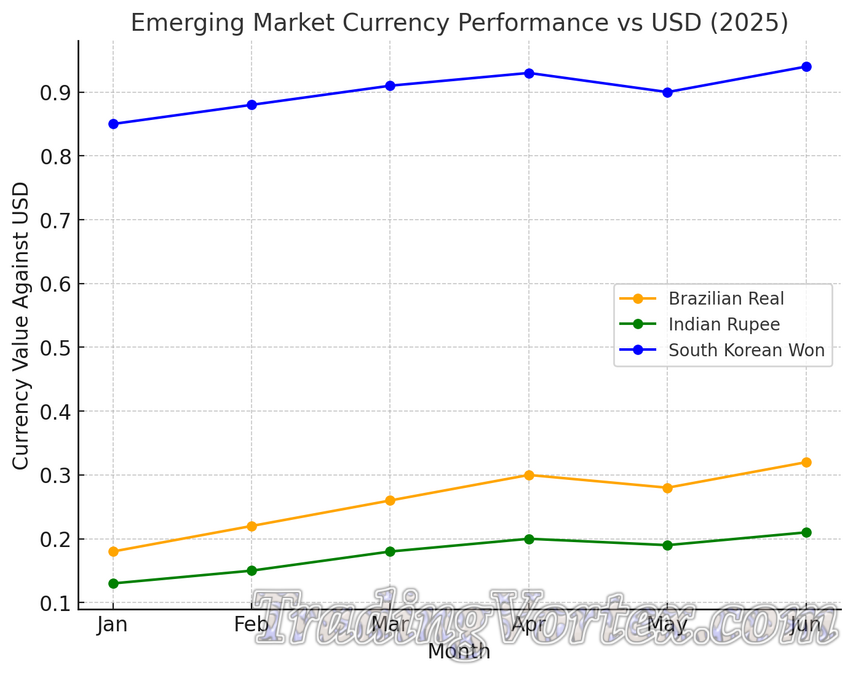

One of the lesser-discussed factors driving the growth of emerging market ETFs is the relative undervaluation of many emerging market currencies. In comparison to the U.S. dollar, several emerging market currencies are trading at historically low levels, making them potentially lucrative for investors with a longer-term view.

Currency fluctuations can significantly impact the returns of emerging market ETFs. When a country's currency appreciates against the U.S. dollar, investors who hold local currency assets may experience higher returns. Conversely, when the dollar strengthens, investors may see their returns dampened. However, with many emerging market currencies currently undervalued, there is a strong potential for appreciation in the medium term, especially as global inflation rates stabilize and international trade continues to expand.

How Currency Fluctuations Affect ETF Returns:

Currency fluctuations can either enhance or erode the returns of emerging market ETFs. An ETF that invests in a basket of local assets, such as stocks and bonds, can see its overall performance influenced by the movements of the underlying currencies. If the value of an emerging market currency rises against the U.S. dollar, the dollar-denominated returns from that market will increase. Conversely, a depreciation in the local currency can lead to a decrease in returns for U.S. investors.

In 2025, many emerging market ETFs are benefiting from favorable currency movements, especially as the U.S. dollar has weakened slightly. Funds like the Schwab Emerging Markets Equity ETF (SCHE), which provides broad exposure to a range of emerging economies, have gained traction as a result of strengthening local currencies in several markets. When evaluating an ETF, it's crucial to assess its currency exposure and understand the potential impact of currency movements on its overall returns. Diversification across both regions and currencies can help mitigate these risks.

Risks of Sector Overconcentration:

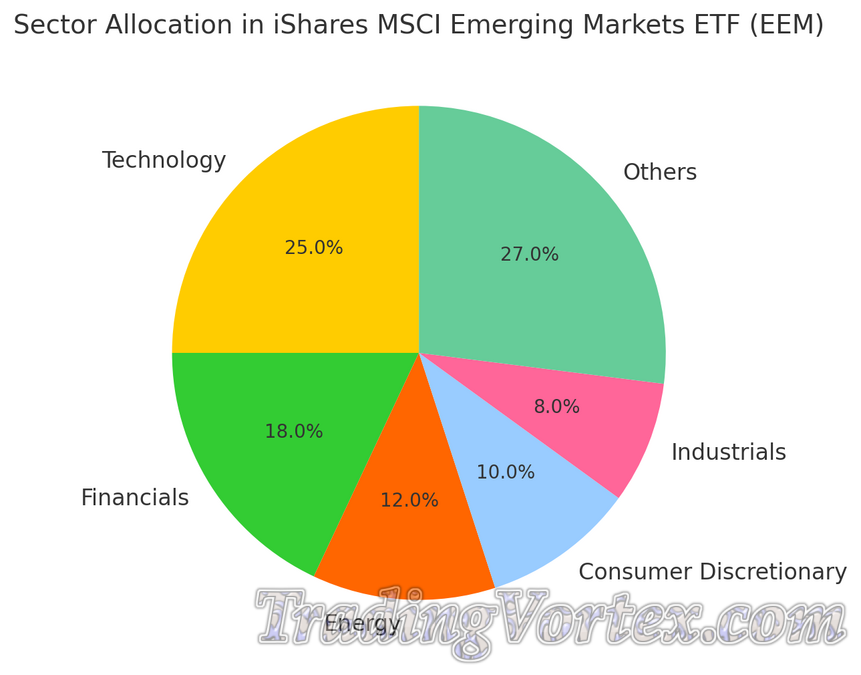

Tech Giants Like TSMC and the Impact on Diversification:

While emerging markets present numerous opportunities, investors should also be mindful of the risks associated with sector overconcentration. A prime example of this risk is the dominance of technology companies like Taiwan Semiconductor Manufacturing Company (TSMC) in many emerging market ETFs. TSMC alone constitutes a large portion of the portfolios of ETFs like the iShares MSCI Emerging Markets ETF (EEM) and the Vanguard FTSE Emerging Markets ETF (VWO), with exposure to this single company often exceeding 5% of the total fund.

While TSMC has undoubtedly been a high-performing company, its heavy weighting in several emerging market ETFs could lead to reduced diversification, leaving investors exposed to sector-specific volatility.

How to Identify and Avoid Overweighted Sector Exposure:

Investors looking to avoid overexposure to any single sector within an emerging market ETF should focus on diversification. Here are a few tips to manage this risk:

- Review Sector Allocations: Before investing in any ETF, check the sector breakdown and ensure there is a healthy distribution across various industries. If technology or a single sector dominates the fund, consider opting for a more balanced ETF or using sector-specific funds for targeted exposure.

- Choose Equal-Weight ETFs: Some ETFs are designed to have an equal-weighted structure, which helps to mitigate the risks of overexposure to any single sector or stock. These funds tend to have more balanced exposure, which can reduce the volatility associated with concentrated sectors.

- Consider Thematic ETFs: If you're specifically interested in sectors like technology, consider thematic ETFs that focus solely on that sector. This allows for direct exposure without impacting overall portfolio diversification.

- Monitor Market Trends: Keep an eye on how certain sectors are performing. If one sector is disproportionately influencing the fund’s returns, it may be time to reassess your investment or rebalance your portfolio.

By understanding these trends, investors can make informed decisions when considering Emerging Market ETFs for their portfolios. Whether you're seeking growth, diversification, or looking to take advantage of currency fluctuations, keeping an eye on these key trends will help guide your investment strategy for 2025 and beyond.

Capital Flows in 2025: This bar chart illustrates the shifts in capital flows, highlighting the outflows from U.S. equity funds and the inflows into European and Asian equity funds. It shows the trend of investors redirecting capital into emerging markets as a safer and more profitable option in 2025.

Currency Performance Against USD: This line chart displays the performance of three emerging market currencies (Brazilian Real, Indian Rupee, and South Korean Won) against the U.S. dollar from January to June 2025. The chart demonstrates how currency trends can impact emerging market ETF returns, showing the potential for growth as some of these currencies appreciate against the dollar.

Sector Allocation in iShares MSCI Emerging Markets ETF (EEM): This pie chart provides a breakdown of the sector allocation within the iShares MSCI Emerging Markets ETF (EEM). As you can see, the tech sector makes up a significant portion of the fund, which is a key point when considering diversification and avoiding overexposure to one sector.

Smart Strategies to Diversify with Emerging Market ETFs:

Regional Diversification – Go Beyond Asia:

How to Balance Exposure Across Latin America, Africa, and Asia:

While Asia has traditionally been the dominant player in emerging market ETFs, focusing solely on this region can limit your portfolio's potential. Latin America and Africa present unique investment opportunities that can be highly rewarding when approached with the right strategy.

Latin America: The region is home to emerging markets like Brazil, Mexico, and Chile, each offering distinct investment opportunities.

- Brazil's economy is heavily dependent on commodities, and as a result, it can be highly sensitive to global commodity prices. ETFs like the iShares MSCI Brazil ETF (EWZ) give exposure to Brazil's top sectors, including energy, materials, and financials.

- Mexico, on the other hand, is positioned as a key player in North American manufacturing, especially with its proximity to the U.S. economy. This dynamic makes Mexico ETFs, such as the iShares MSCI Mexico ETF (EWW), an interesting option for investors looking to capitalize on the country's manufacturing and trade growth.

Africa: Sub-Saharan Africa, with its growing populations and infrastructure developments, presents compelling growth opportunities. Countries like Nigeria, South Africa, and Kenya are diversifying their economies, making them attractive for long-term investments. The Global X MSCI Nigeria ETF (NGE) and iShares MSCI South Africa ETF (EZA) are just a few examples of funds that give targeted exposure to African economies. In particular, the rise of mobile technology and digital infrastructure in countries like Kenya (often referred to as "Silicon Savannah") is creating new investment avenues, especially in tech-focused ETFs.

Asia: While Asia remains the most significant player in emerging markets, it’s essential to diversify even within the region. China’s economic transformation continues to reshape its industries, with sectors such as technology, consumer goods, and healthcare leading the way. ETFs like the iShares MSCI China ETF (MCHI) or the Xtrackers MSCI China A-shares ETF (ASHR) provide focused exposure to Chinese companies. However, countries like India, Vietnam, and Indonesia are also gaining ground. India, with its burgeoning middle class, is often considered a growth engine for the next decade, making ETFs like the iShares MSCI India ETF (INDA) or the WisdomTree India Earnings Fund (EPI) attractive options.

Balancing exposure across these regions reduces your portfolio’s reliance on one market and increases the chances of benefitting from growth in multiple areas. By diversifying across Latin America, Africa, and Asia, you can reduce risk and tap into the growth potential of emerging economies beyond just the well-known markets in Asia.

Single-Country vs. Multi-Country ETFs: Which Is Better?

When choosing between single-country and multi-country ETFs, it’s important to consider your risk tolerance and investment goals.

- Single-Country ETFs: These funds focus on a specific country and give you direct exposure to that nation’s economic performance. Single-country ETFs can be highly rewarding, especially in countries experiencing rapid economic growth. For example, the Global X MSCI China Technology ETF (CHIK) focuses solely on China’s tech sector. However, this approach comes with higher risk due to the possibility of political instability, currency fluctuations, or economic downturns within that specific country. If the country faces a crisis or slowdown, your investment could be negatively impacted.

- Multi-Country ETFs: On the other hand, multi-country ETFs spread risk across various countries within a particular region or even globally. For example, the iShares MSCI Emerging Markets ETF (EEM) provides exposure to a basket of countries, including China, India, Brazil, and South Africa, which reduces your exposure to the volatility of any single country. Multi-country ETFs are ideal for those who want broader diversification and are looking to capture growth across a variety of emerging markets.

The decision depends on whether you're willing to take on more risk for potentially higher rewards with single-country ETFs, or if you prefer the relative safety and broad exposure offered by multi-country funds.

Sector Diversification – Spreading Risk Across Industries:

How to Choose ETFs with Exposure to Tech, Energy, and Healthcare:

Emerging markets are home to a wide range of industries, each presenting different growth potential. By investing in sector-specific ETFs, you can gain exposure to high-growth industries within emerging economies.

- Technology: The tech sector has been a significant driver of growth in emerging markets, particularly in countries like China, India, and South Korea. ETFs like the Global X MSCI China Information Technology ETF (CHIK) and the First Trust Chindia ETF (FNI), which combines exposure to both China and India, provide focused exposure to tech stocks. These ETFs allow investors to capitalize on the growth of tech giants and startups in emerging economies that are driving global innovation, particularly in mobile technology, e-commerce, and fintech.

- Energy: Energy is a critical sector in many emerging markets, particularly in oil and gas-rich countries like Brazil, Russia, and Nigeria. The iShares MSCI ACWI ex U.S. Energy ETF (XLE) and the VanEck Vectors Oil Services ETF (OIH) provide diversified exposure to the energy sector in emerging markets. With energy demand expected to rise as developing countries industrialize, the energy sector in emerging markets offers significant growth potential. These ETFs allow investors to tap into energy companies that stand to benefit from global shifts in energy consumption.

- Healthcare: The healthcare sector in emerging markets has seen rapid growth, driven by rising income levels, expanding middle classes, and aging populations. ETFs like the iShares MSCI Global Healthcare ETF (IXJ) and the Global X MSCI China Healthcare ETF (CHIH) provide exposure to companies working to address the growing demand for healthcare services and pharmaceuticals. The pandemic has highlighted the importance of robust healthcare systems, and with greater access to healthcare in emerging economies, this sector presents long-term investment opportunities.

By diversifying across sectors such as technology, energy, and healthcare, you reduce the risk associated with any single sector while positioning your portfolio to benefit from the rapid development of diverse industries in emerging markets.

Thematic ETFs – Targeting Growth Sectors in Emerging Markets:

Thematic ETFs are a powerful tool for targeting specific growth trends within emerging markets. These funds focus on specific themes, such as sustainable investing, infrastructure development, or renewable energy, which are expected to see significant growth in the coming years.

By selecting thematic ETFs, you can invest in sectors or trends that align with your long-term investment thesis, such as environmental sustainability or technological innovation. These funds give you the flexibility to invest in specific high-growth areas while maintaining exposure to the broader emerging market ecosystem.

Long-Term vs. Tactical Investment Approaches:

Buy-and-Hold vs. Active Rotation: What Works Best?

The decision between buy-and-hold and active rotation strategies depends largely on your investment style and the time horizon of your goals.

- Buy-and-hold investors focus on long-term trends and invest in emerging market ETFs with the expectation that these economies will continue to grow over time. This strategy works well in emerging markets, which tend to offer long-term growth potential, particularly as younger populations and rising middle classes expand.

- On the other hand, active rotation involves adjusting your ETF holdings based on market conditions, economic forecasts, or short-term trends. Active investors may rotate between sectors, countries, or even different types of ETFs as conditions evolve. For instance, if you believe that Latin America will outperform other regions in the next year, you may rotate your portfolio to increase exposure to funds like the iShares MSCI Latin America ETF (ILF). While more hands-on, active rotation can help capitalize on short-term opportunities.

Using Dollar-Cost Averaging for Market Volatility:

One of the most reliable strategies for mitigating the impact of market volatility is dollar-cost averaging (DCA). This method involves investing a fixed amount at regular intervals, regardless of market conditions. By doing so, you reduce the risk of investing a large sum during a market peak and smooth out the effects of short-term volatility. For emerging market ETFs, DCA allows you to take advantage of price fluctuations without trying to time the market, making it particularly useful in volatile regions where emerging markets can fluctuate significantly in the short term.

Timing Entry Points with Market and Macro Signals:

While timing the market perfectly is challenging, keeping an eye on macroeconomic indicators — such as interest rates, inflation, and GDP growth — can help inform your investment decisions. Monitoring global economic trends and regional conditions allows investors to identify potentially favorable entry points.

Additionally, geopolitical events can influence market timing. Emerging markets can be sensitive to political changes, trade agreements, or even changes in commodity prices. By paying attention to such signals, you can optimize your entry points for a more effective investment strategy.

By employing these smart strategies, you can enhance the diversification of your portfolio through Emerging Market ETFs, mitigating risks and maximizing long-term growth opportunities. Whether you opt for regional diversification, sector allocation, or a specific investment approach, the key is to stay informed, adjust to changing conditions, and maintain a well-rounded strategy that suits your investment goals.

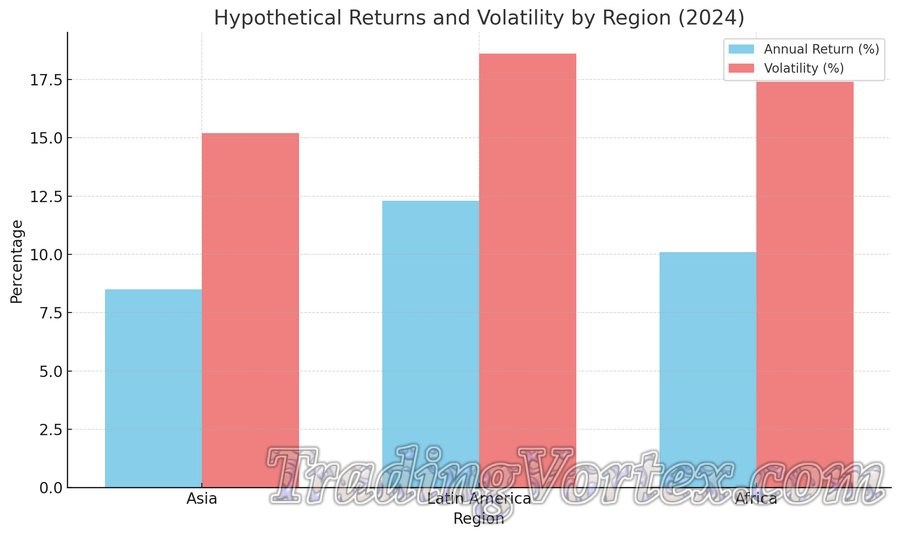

Visual representation comparing hypothetical annual returns and volatility across different emerging market regions. It helps illustrate why spreading exposure across Asia, Latin America, and Africa can be a smart move — balancing potential returns with risk in your diversification strategy.

Risk Management in Emerging Market ETF Investing:

Emerging markets can offer remarkable growth potential, but they are not without their risks. Successful investing in emerging market ETFs is not just about choosing the right regions or sectors; it’s also about knowing how to anticipate, navigate, and mitigate the specific risks associated with these dynamic economies. Whether you are just starting out or fine-tuning a global portfolio, understanding these risks will help you make smarter, more resilient investment decisions.

Political and Regulatory Instability:

How to Evaluate and Manage Country-Specific Political Risks:

One of the most persistent risks in emerging markets is political instability. Regulatory uncertainty, national elections, abrupt policy shifts, or social unrest can directly impact stock markets and investor confidence.

To mitigate these risks, investors should consider the following approaches:

- Diversify Across Countries: Avoid putting all your emerging market exposure in a single country. Regional ETFs like the iShares MSCI Emerging Markets ETF (EEM) or the Vanguard FTSE Emerging Markets ETF (VWO) offer broad country exposure, reducing the impact of adverse events in any one nation.

- Track Political Risk Ratings: Use tools such as the Political Risk Index from the Economist Intelligence Unit (EIU) or World Bank’s Worldwide Governance Indicators to evaluate the stability of countries you're exposed to.

- Monitor Election Cycles and Policy Reform Trends: Elections often trigger market volatility. Pay attention to proposed fiscal, monetary, and trade reforms as well as international relations.

- Stay Updated with Global News and Alerts: Apps like Bloomberg Terminal, Reuters, or even Google Alerts filtered by country and topic can help you track significant developments in real time.

Key Resources for Monitoring Political and Regulatory Developments:

- International Crisis Group: Offers detailed country reports and geopolitical analysis.

- Morningstar Analyst Reports: Provides ETF-specific risk assessments, including exposure to regulatory changes.

- ETF Provider Updates: Many fund issuers publish regular commentary on political developments affecting their portfolios.

Currency Volatility and Hedging Strategies:

How Currency Fluctuations Impact ETF Performance:

Currency risk is often underestimated by retail investors, but it can have a substantial impact on returns. When a local currency weakens against the investor's base currency (often the U.S. dollar), it can erode gains made in the underlying equity markets. This is particularly relevant in countries with volatile exchange rates or weak monetary policy frameworks, such as Turkey or South Africa.

Should You Use Currency-Hedged ETFs?

Here’s how to evaluate whether to hedge:

- Time Horizon: Short-term investors may benefit more from currency-hedged strategies to limit volatility. Long-term investors may ride out the currency cycles.

- Market Outlook: If the U.S. dollar is expected to strengthen, hedged ETFs can protect against local currency losses. In contrast, if emerging market currencies are undervalued and expected to rise, unhedged ETFs may offer better returns.

- Cost-Benefit Analysis: Hedging adds costs. Make sure the additional expense ratio justifies the benefit, especially in less volatile environments.

- Partial Hedging as a Compromise: Some investors choose to split their investments between hedged and unhedged ETFs to balance risk and cost.

Liquidity and Trading Challenges:

What You Need to Know About Liquidity in Emerging Market ETFs:

Liquidity is a critical consideration when investing in ETFs, especially those with exposure to smaller or less-developed markets. Unlike developed market ETFs that typically see high daily volume and tight bid-ask spreads, emerging market ETFs can suffer from wider spreads, limited trade size capacity, and higher volatility.

Factors affecting ETF liquidity include:

- Underlying Market Liquidity: If the stocks within the ETF are thinly traded in their home markets, the ETF itself will reflect that.

- Time Zone Misalignment: Emerging markets may operate in different time zones, leading to pricing inefficiencies during U.S. trading hours.

- ETF Size and AUM: Funds with higher assets under management and volume tend to offer better liquidity. Examples include VWO, EEM, and IEMG (iShares Core MSCI Emerging Markets ETF).

Practical Tips for Managing Liquidity Risks:

- Stick with High-Volume ETFs: Use tools like ETF.com or Morningstar to check daily trading volume and average bid-ask spreads.

- Avoid Trading at Market Open or Close: Prices tend to be more volatile at the beginning and end of the trading day. Mid-day trades often offer tighter spreads.

- Use Limit Orders Instead of Market Orders: This allows you to control the price you pay and avoid getting filled at unexpected prices during low-volume periods.

- Review ETF Holdings: Examine the liquidity of top holdings within the ETF to get a better sense of what drives the fund’s behavior.

Final Thought – Risk Doesn’t Mean Avoidance:

It is easy to let risk scare you away from emerging markets, but the reality is that every market carries risk: just in different forms. What sets successful investors apart is not the ability to avoid risk, but to understand it, prepare for it, and manage it with care. Emerging market ETFs can play a rewarding role in a diversified portfolio when approached thoughtfully.

With proper diversification, real-time information tools, and smart selection of ETFs, you can build exposure to the world’s fastest-growing economies while protecting your downside. Risk, when managed well, can become an advantage.

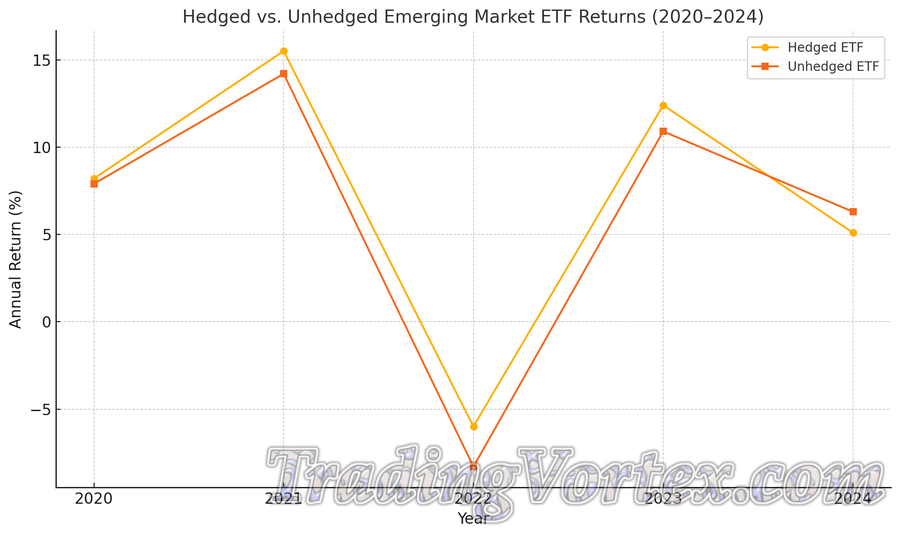

Visual comparison of hedged versus unhedged emerging market ETF returns from 2020 to 2024. This chart illustrates how currency volatility can significantly affect performance, especially during turbulent macroeconomic conditions. Investors using hedged ETFs may experience more stable returns, particularly when foreign currencies weaken against their base currency.

Best Emerging Market ETFs to Watch in 2025:

Choosing the right emerging market ETF can feel a bit like scanning a global buffet: you want to sample widely, but you also want to make sure you’re not overloading your plate with all the same flavor. In 2025, several ETFs stand out for their performance, cost efficiency, and exposure strategies. Whether you're a seasoned trader or just beginning to explore global diversification, these funds are worth a close look.

Vanguard FTSE Emerging Markets ETF (VWO):

Broad Exposure, Minimal Cost, and a Passive Giant:

If you're looking for an efficient, low-cost entry point into emerging markets, VWO remains one of the most attractive options. It tracks the FTSE Emerging Markets All Cap China A Inclusion Index, which covers large-, mid-, and small-cap stocks. That gives investors access to more than 5,000 companies across over 20 countries, including China, Brazil, India, and South Africa.

Why VWO stands out in 2025:

- Expense Ratio: 0.10%, making it one of the most affordable broad-market EM ETFs available.

- Top Country Allocations: China (~30%), India, Taiwan, Brazil.

- Sector Breakdown: Financials, technology, and consumer discretionary top the list.

- Assets Under Management (AUM): Over $70 billion as of Q1 2025, which provides robust liquidity and stability.

What makes VWO appealing is its wide net and low barrier to entry. If you're aiming to “own the emerging world” without overthinking it, this ETF does the heavy lifting for you. It is ideal for long-term investors with a passive approach who want diversified exposure across multiple regions and industries.

iShares MSCI Emerging Markets ETF (EEM):

A Veteran ETF with Blue-Chip Exposure:

Launched in 2003, EEM is one of the oldest and most widely traded emerging market ETFs. It tracks the MSCI Emerging Markets Index, providing access to more than 1,000 large- and mid-cap companies. If you're looking for more stability in an otherwise volatile space, this fund's focus on established names might appeal to you.

Why investors still choose EEM:

- Expense Ratio: 0.68% — higher than VWO and IEMG, but justified by liquidity and trade volume.

- Top Holdings: Taiwan Semiconductor Manufacturing Company (TSMC), Tencent, Samsung.

- Country Exposure: Heavy allocations to China, Taiwan, and South Korea.

- AUM: Over $25 billion, making it a popular choice among institutional investors.

Traders who prioritize high liquidity and tight bid-ask spreads may favor EEM, even if the fees are a bit steeper. This ETF can be particularly useful for short- to mid-term tactical plays, especially during market swings or macro events.

iShares Core MSCI Emerging Markets ETF (IEMG):

All-in-One Exposure That Includes Small-Caps:

If VWO is a good baseline and EEM is the heavyweight champ, then IEMG is the well-rounded athlete. It tracks the MSCI Emerging Markets Investable Market Index (IMI), offering exposure to over 2,700 stocks, including small- and micro-cap companies often missed by larger ETFs.

What makes IEMG powerful in 2025:

- Expense Ratio: 0.09%, currently one of the lowest in the category.

- Diversified Holdings: Includes names across large-, mid-, and small-cap spaces.

- Top Sectors: Financials, technology, and communication services.

- Global Reach: Balanced exposure to Asia, Latin America, Eastern Europe, and Africa.

IEMG is a favorite among long-term investors who want depth and don’t mind a bit of extra volatility from smaller companies. With more comprehensive coverage and a lower fee than EEM, it offers a compelling alternative for cost-conscious investors looking for broader representation.

Bonus Mentions – Up-and-Coming or Niche Players:

Here are a few more ETFs gaining traction in 2025:

- Franklin FTSE India ETF (FLIN): Focused exposure to one of the fastest-growing economies, with minimal fees (0.19%) and strong recent performance.

- Global X MSCI China Consumer Discretionary ETF (CHIQ): A thematic ETF for those betting on China’s rising middle class and consumerism trends.

- iShares MSCI Frontier and Select EM ETF (FM): Targets “next-generation” markets like Vietnam, Nigeria, and Kazakhstan for more adventurous investors.

These niche funds allow for targeted plays if you want to emphasize a particular region or theme within the broader emerging market universe.

Final Takeaway – Choosing the Right Fund for You:

There’s no “one-size-fits-all” ETF for emerging market investing. Your decision should reflect your time horizon, risk tolerance, and overall investment strategy:

- Want low cost and breadth? Go with VWO or IEMG.

- Need high liquidity for active trading? EEM is your ally.

- Looking for targeted plays? Explore FLIN, CHIQ, or FM for regional or thematic angles.

Whichever you choose, the key is to treat these ETFs as part of a well-thought-out portfolio strategy. As always, it's a good idea to review the underlying holdings, check recent performance and country weightings, and consider how each fund complements your existing assets.

Diversifying with emerging markets is no longer a fringe strategy. It’s becoming essential. And with these ETFs, you have more tools than ever to do it right.

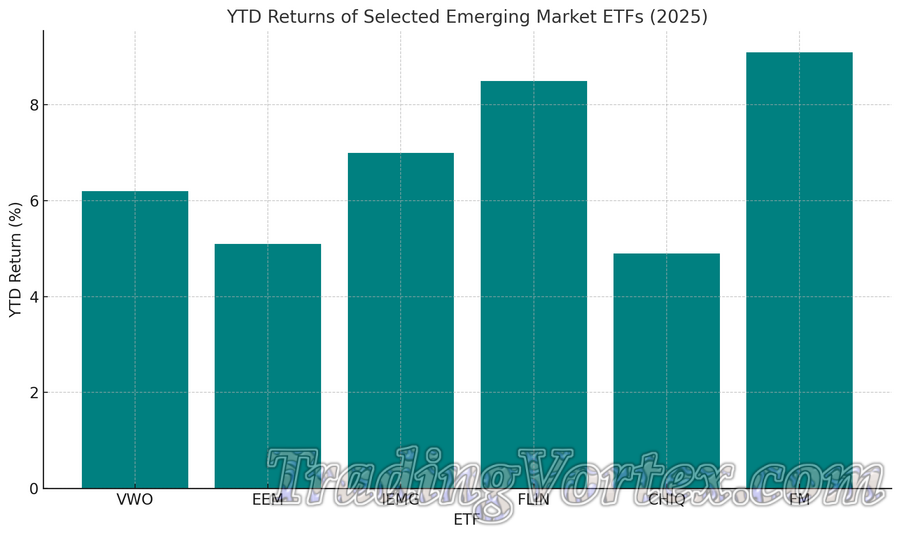

Visual chart illustrating the year-to-date returns of some of the top emerging market ETFs in 2025. This can help investors quickly compare performance and gain perspective on where value may lie.

ESG Investing in Emerging Markets – A Growing Priority:

Why ESG Factors Matter More Than Ever:

Environmental, Social, and Governance (ESG) investing is no longer a niche. In 2025, it has become a mainstream consideration for both institutional and retail investors; and its relevance in emerging markets is particularly profound. These regions, which include countries across Latin America, Asia, Eastern Europe, and Africa, are increasingly seen as battlegrounds for both financial opportunity and sustainable transformation.

Emerging markets often face more pronounced challenges in environmental degradation, human rights issues, and political instability. However, these same regions are also where some of the most promising ESG-focused reforms and innovations are taking place.

For investors who care about long-term risk-adjusted returns and global impact, this duality makes ESG investing not just worthwhile but necessary.

BlackRock’s 2025 outlook highlights a continued surge in ESG fund flows, with emerging market ESG assets growing at nearly twice the pace of their non-ESG counterparts. This shift is supported by growing regulatory frameworks, cross-border sustainability goals, and increasing demand for transparency from both investors and consumers.

Environmental, Social, and Governance Trends in 2025:

- Environmental: Many emerging economies are grappling with the effects of climate change, such as water scarcity, deforestation, and increased carbon emissions. In response, a number of countries: India, Brazil, South Africa, and Indonesia among them; are doubling down on green energy initiatives. The global push for net-zero emissions is trickling into regional policy, encouraging investment in solar, wind, and sustainable infrastructure. In 2024 alone, green bond issuance from emerging markets increased by more than 35 percent, according to the Climate Bonds Initiative.

- Social: Social concerns are gaining prominence as investors recognize their impact on stability and growth. Key themes include labor conditions, gender and income inequality, and community engagement. For example, a growing number of companies in countries like Chile and Vietnam are being rewarded for inclusive employment practices and commitment to education and health access. Socially conscious investors are increasingly focusing on how companies interact with and uplift the communities where they operate.

- Governance: Good governance is the backbone of successful ESG investing. In 2025, emerging markets are witnessing meaningful progress in areas such as anti-corruption measures, board independence, and corporate disclosures. Governments are responding with updated frameworks, such as Brazil's strengthened B3 corporate governance requirements and India's new business responsibility and sustainability reporting (BRSR) mandates. This momentum is helping reduce investment risk while improving corporate accountability.

How ESG Is Changing the Emerging Markets Landscape:

The integration of ESG principles into emerging market investing is changing not just which companies receive capital, but also how they operate. Companies that align themselves with sustainability goals are finding it easier to attract foreign investment and secure international partnerships.

At the same time, ESG considerations are becoming performance factors rather than trade-offs. A 2024 report by Morningstar found that emerging market funds with high ESG ratings outperformed their non-ESG counterparts by 2.3 percent over a 12-month period. This is particularly true during times of volatility, when companies with better ESG scores often show more resilience due to stronger management practices and stakeholder trust.

Finding ESG-Focused Emerging Market ETFs:

What to Look for in ESG-Compliant Funds:

Not all ESG funds are created equal. When selecting an ESG-focused ETF in emerging markets, here are key criteria to consider:

- Index methodology: Examine how the fund defines and measures ESG compliance. Does it exclude certain sectors like fossil fuels or tobacco? Does it use positive screening to include best-in-class performers?

- Transparency: Look for ETFs that disclose their ESG scoring models, methodologies, and updates. Reliable funds often provide ESG ratings from firms like MSCI, Sustainalytics, or Refinitiv.

- Geographic and sector exposure: Determine whether the fund has broad geographic coverage or is concentrated in specific countries. Diversification can reduce risk while maintaining ESG exposure.

- Tracking error and performance consistency: ESG funds can sometimes deviate from traditional benchmarks. Compare long-term returns and volatility metrics to gauge risk-adjusted performance.

- Expense ratios: Costs matter, particularly in ETFs. Lower-fee funds tend to deliver better net returns over time, assuming similar exposure and strategy.

Popular ESG ETFs Targeting Emerging Economies:

Here are several ESG ETFs that provide diversified exposure to emerging markets while aligning with sustainable principles:

- iShares ESG Aware MSCI Emerging Markets ETF (ESGE): This fund tracks an index that tilts toward companies with strong ESG scores across sectors and countries. It excludes tobacco, controversial weapons, and thermal coal.

- Nuveen ESG Emerging Markets Equity ETF (NUEM): Designed with a multi-factor ESG screen, NUEM focuses on companies with long-term sustainability potential. The fund also incorporates community and human rights filters.

- Xtrackers MSCI Emerging Markets ESG Leaders Equity ETF (EMSG): This fund selects high ESG performers from across emerging markets, offering a blend of environmental stewardship, social impact, and governance integrity.

- Putnam PanAgora ESG Emerging Markets Equity ETF (PPEM): This actively managed fund uses quantitative models to select stocks based on ESG momentum. It provides deeper exposure to dynamic ESG themes in underrepresented regions.

Investors should review the holdings and screening processes of each ETF, as approaches can vary significantly. Some use exclusionary tactics, while others apply ESG tilts or active management to achieve sustainability goals.

Final Thoughts:

ESG investing in emerging markets represents a powerful way to align your portfolio with global change. It combines the pursuit of financial returns with a commitment to ethical, social, and environmental progress. While the path may come with complexities, the long-term upside — both financially and morally — can be worth the effort.

Investors who do their homework, stay informed about regional trends, and choose funds carefully can participate in one of the most promising areas of the investment landscape today. ESG is no longer just a filter; in emerging markets, it is fast becoming the lens through which the future is viewed.

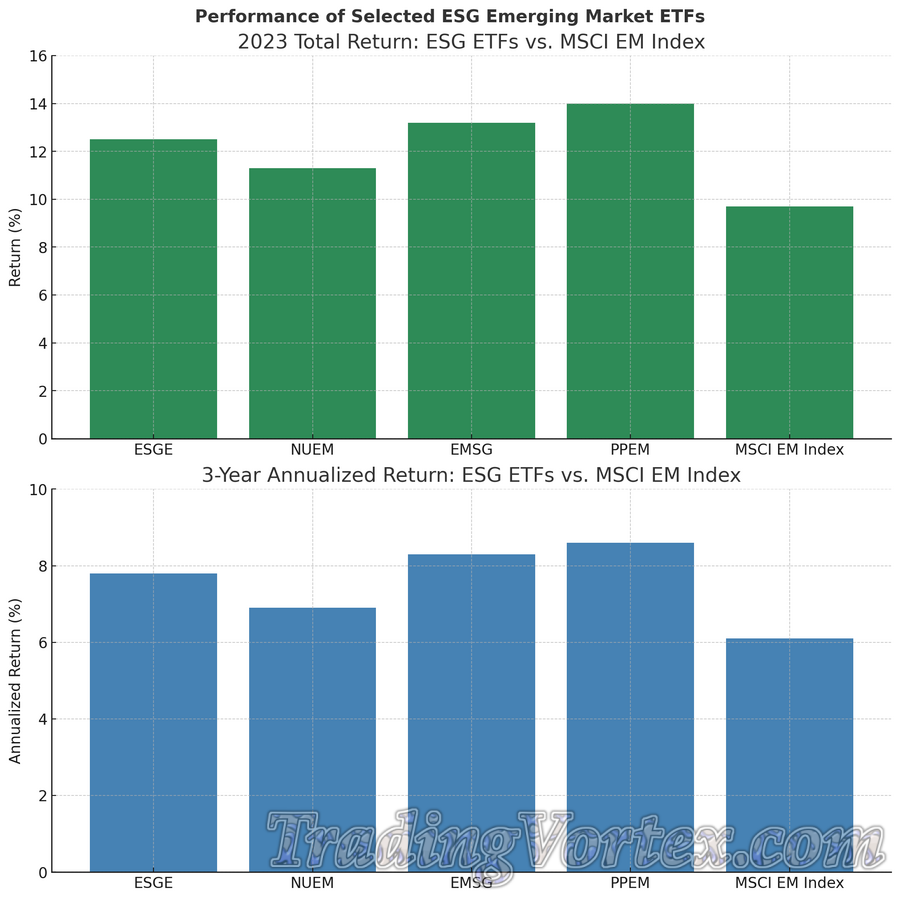

Visual comparison of selected ESG-focused Emerging Market ETFs against the broader MSCI Emerging Markets Index:

♦ The first chart shows total returns for 2023, where ESG ETFs like PPEM and EMSG outperformed the MSCI EM Index.

♦ The second chart highlights the three-year annualized returns, reflecting sustained performance and potential consistency in ESG-aligned funds.

These visuals help illustrate that many ESG ETFs not only align with ethical investing goals but also stand their ground competitively in terms of returns.

Conclusion – Building a Future-Ready Portfolio with Emerging Market ETFs:

Embracing Diversification – Key Strategies for 2025:

In 2025, diversification remains an essential principle in portfolio management, and Emerging Market (EM) ETFs continue to play a vital role in helping investors achieve this goal. While markets like the U.S. and Europe have long been the go-to destinations for investors, emerging markets offer untapped growth opportunities that can help to balance out the risks of developed markets.

Emerging economies — such as those in Asia, Latin America, and Africa — are expected to see continued growth, driven by factors such as increasing consumer demand, rapid technological innovation, and expanding infrastructure.

Recent data suggests that emerging market equities have outperformed their developed counterparts in 2025, particularly within sectors like technology, clean energy, and commodities. This performance highlights the importance of including EM ETFs in a diversified portfolio, as they can help smooth out volatility while providing access to markets with significant growth potential.

Moreover, EM ETFs provide broad geographic exposure, reducing the reliance on any single market or region. Investors are not just limited to one country or sector but can access a wide variety of emerging economies, each offering unique opportunities and risks.

Aligning Emerging Market Exposure with Your Risk Profile:

Investing in emerging markets does come with inherent risks. Factors such as political instability, currency fluctuations, and economic volatility can contribute to market uncertainty. However, these risks are often paired with higher growth potential compared to developed economies, creating an interesting risk-reward dynamic.

To effectively align emerging market exposure with your risk tolerance, it is essential to:

- Understand Your Risk Appetite: Determine whether you are more comfortable with the potential volatility that comes with EM markets or whether you prefer the relative stability of developed market investments. Emerging markets tend to be more volatile, but they also offer higher potential returns, which may be suitable for investors with a longer-term horizon.

- Diversify Within Emerging Markets: Do not put all your eggs in one basket. Spread your investments across multiple countries and sectors within emerging markets. For example, you might choose a mix of ETFs that focus on technology in Asia, energy in the Middle East, and consumer goods in Latin America. This strategy helps mitigate country-specific and sector-specific risks.

- Opt for Low-Cost, Broad ETFs: If you are new to emerging markets, it may be worth considering broad ETFs, such as the iShares MSCI Emerging Markets ETF (EEM) or the Vanguard FTSE Emerging Markets ETF (VWO). These funds provide exposure to a wide array of markets and industries, which can help smooth out the volatility typically associated with individual emerging market investments.

Staying Adaptive – Monitoring Trends and Adjusting Strategies:

The global investment landscape is continuously evolving, shaped by shifting economic, geopolitical, and market dynamics. In 2025, several key trends are influencing the outlook for emerging markets, and staying informed about these changes is crucial to maintaining a resilient portfolio.

- Policy Uncertainty: Emerging markets face prolonged periods of policy uncertainty, which may affect investment strategies. For example, trade tensions between China and the U.S. could affect supply chains, while geopolitical tensions in Latin America or Africa might alter investor sentiment. Keeping a close eye on these developments can help you adjust your strategy accordingly.

- Growth in Emerging Economies: Despite global challenges, emerging economies are still poised for long-term growth. As developed markets like the U.S. and Europe experience slower economic recovery, countries in Asia, Africa, and Latin America are expected to continue expanding at a faster pace. For instance, India’s tech industry and Africa’s renewable energy sector are areas of interest for investors looking to diversify.

- ESG Considerations: Environmental, Social, and Governance (ESG) factors are increasingly shaping investment decisions, even in emerging markets. Investors are now focusing on how countries and companies in these regions are addressing environmental concerns, social inequality, and corporate governance practices. As a result, ESG-focused ETFs are gaining popularity, providing a responsible investment vehicle for those who want to align their portfolios with their values.

- Inflation and Currency Volatility: Currency fluctuations in emerging markets can impact returns, especially for U.S. investors. Currency devaluation can erode ETF returns, so monitoring macroeconomic indicators and exchange rate trends is crucial. To hedge against such risks, consider adding currency-hedged ETFs to your portfolio, or diversify across multiple currencies to spread the risk.

Practical Tips for Future-Ready EM ETF Investing:

- Monitor Global Economic Indicators: Regularly check global economic reports, including inflation rates, GDP growth, and trade balance statistics. These can provide insights into the future performance of emerging economies.

- Track Emerging Market Trends: Keep an eye on key sectors driving growth in emerging markets. For example, technology and clean energy sectors are receiving increasing attention as many EM countries push for green energy transitions and digital innovation.

- Rebalance Regularly: As market conditions change, so should your portfolio. Rebalancing ensures that your investment exposure aligns with your current financial goals and risk tolerance.

- Consider ESG ETFs: If you are focused on sustainable investing, consider adding ESG-compliant emerging market ETFs to your portfolio. These ETFs target companies that are leaders in environmental responsibility, social initiatives, and good governance practices. They allow you to invest in emerging markets while contributing to positive global change.

- Consult Financial Professionals: It’s always a good idea to work with a financial advisor who can help you navigate the complexities of emerging market investing. They can assist in choosing the right funds, ensuring that your portfolio matches your risk profile, and helping you understand global macroeconomic shifts.

Final Thoughts:

Building a future-ready portfolio with Emerging Market ETFs involves strategic diversification, understanding the risks associated with these markets, and staying adaptable as the global landscape evolves. As emerging markets continue to grow and change, staying informed about key trends and maintaining a diversified approach will be critical in capturing long-term opportunities. By carefully monitoring these markets, adjusting your portfolio as needed, and investing for the long term, you can build a resilient and future-ready portfolio that balances growth potential with risk management.

Frequently Asked Questions – Navigating Emerging Market ETFs:

Q1. What exactly are Emerging Market ETFs?

Emerging Market ETFs (Exchange-Traded Funds) are investment vehicles that track a collection of stocks from countries that are still developing economically. These include major players like China, India, and Brazil, as well as lesser-known markets across Africa and Eastern Europe. By investing in one ETF, you’re essentially gaining exposure to dozens or even hundreds of companies from these fast-growing regions.

Q2. Why should I consider adding them to my portfolio?

Because they offer growth potential that’s hard to ignore. Developed markets are mature and often slower-growing. Emerging markets, on the other hand, can deliver impressive returns, especially when global economic cycles shift in their favor. More importantly, they allow you to diversify geographically, reducing the overall risk in your portfolio when U.S. or European markets hit a rough patch.

Q3. What are the key risks involved?

Emerging markets aren’t a smooth ride. You’ll need to brace for:

♦ Political instability: Elections, protests, or sudden policy shifts can shake markets overnight.

♦ Currency swings: A strong dollar can wipe out gains in local markets when converted back.

♦ Regulatory gaps: Not every country has the same level of transparency or investor protection.

♦ Liquidity issues: Some stocks in these ETFs are thinly traded, which can affect pricing.

Investing in emerging markets requires a bit of stomach and a lot of patience.

Q4. How do I choose the right ETF?

Start by looking at the basics:

♦ Expense ratio: Lower is better. Fees eat into your returns over time.

♦ Geographic focus: Some ETFs cover broad regions, others focus on one country.

♦ Sectors represented: Are you getting tech, energy, finance, or a mix? Make sure it complements what you already own.

♦ Size and liquidity: Bigger funds usually offer smoother trading and lower bid-ask spreads.

♦ Tracking accuracy: Some ETFs don’t perfectly match their index. A low tracking error is what you want.

A little research goes a long way when picking the right fund.

Q5. Are there tax implications?

Yes, and they vary depending on where you live and the ETF’s structure:

♦ Dividends: Might be taxed at source or in your home country.

♦ Capital gains: Selling for a profit can trigger taxes, depending on your tax bracket and local laws.

♦ Double taxation: Some countries have treaties to avoid this, others don’t.

When in doubt, talk to a tax advisor to keep things clean and compliant.

Q6. How can I manage the risks?

Here are some tried-and-true strategies:

♦ Diversify across countries and sectors. Don’t bet it all on one region.

♦ Use stop-loss orders to protect gains or cap losses.

♦ Invest for the long haul. Short-term swings are common, but the long game is where emerging markets shine.

♦ Monitor global developments. A headline out of Brazil or India might mean more for your portfolio than a Fed speech.

Think chess, not checkers.

Q7. Can I include Emerging Market ETFs in my retirement account?

Absolutely. Most retirement plans, like IRAs or 401(k)s, allow ETF investments. Just make sure the ETF fits your long-term goals and risk tolerance. Retirement portfolios tend to favor stability, so a balanced mix of developed and emerging market exposure often makes the most sense.

Q8. How do currency fluctuations affect performance?

Let’s say your ETF is invested in Brazilian companies. If the real weakens against your home currency, your returns take a hit—even if the local stock market did great. This is where currency-hedged ETFs can come in handy, although they may have slightly higher fees. It’s a trade-off between simplicity and protection.

Q9. Are ESG-focused Emerging Market ETFs worth considering?

If values matter to you, then yes. These ETFs screen for Environmental, Social, and Governance (ESG) criteria, helping you avoid companies involved in pollution, labor violations, or shady governance. It’s a way to invest in growth without compromising on ethics. Just check the methodology used—every ESG fund defines “sustainable” a bit differently.

Q10. How do I stay informed about these markets?

Consistency is key. You can stay in the loop by:

♦ Following global financial news

♦ Reading fund provider updates

♦ Engaging with investor communities

♦ Consulting a financial advisor when major changes arise

The more tuned-in you are, the more confident you’ll feel making smart, timely decisions.

TradingVortex.com® 2019 © All Rights Reserved.

TradingVortex.com® 2019 © All Rights Reserved.